U.S. retail sales in the Nov. 1 to Dec. 24 period, excluding automotive, grew 7.6% compared to the same time in 2021, according to Mastercard Inc.’s SpendingPulse, which tracks in-store and online sales. E-commerce sales alone were up 10.6%. The calculation took account of all forms of payment but was not …

Read More »COMMENTARY: A Forecast for Secure Payments in 2023

The world will not stand still in 2023—not in retail and certainly not in payments. For the coming year, security and automation will be the focus of the trends and innovations we’ll be seeing in the payments space. Let’s explore this further. Credit card tokens from Visa, Mastercard, Discover (Diners), …

Read More »Consumers’ Ailing Financial Health Could Cast a Shadow Over the Holiday Shopping Season

As the holiday shopping season heads into the home stretch, consumer concerns over withered buying power due to inflation is expected to tamp down overall spending, according to J.D. Power’s Banking and Payments Intelligence Report. In a November survey of 4,000 retail bank customers nationwide, 40% said they expect to …

Read More »Crime Ring Targets Online Retailers And Other Digital Transactions News briefs from 12/22/22

A fraud ring that appears to be based in Southeast Asia is targeting U.S. retailers and has already committed an estimated $660 million in fraud in stolen laptops, cell phones, computer chips, gaming devices, and other goods just in November, said Signifyd, an online-fraud prevention firm. Signifyd said it has been tracking …

Read More »Worldline Adds Splitit as a BNPL Option for Merchants

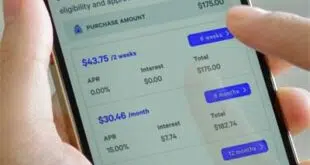

Global processor Worldline S.A. will make Splitit, a white-label buy now, pay later provider, available to its roster of merchants and marketplaces, starting first in North America. Announced Tuesday, the integration will enable Worldline merchants to offer card-based installment payments within the existing checkout flow. Merchants can use their brand …

Read More »Afterpay Most Used BNPL Option by Gen Z And Other Digital Transactions News briefs from 12/15/22

Afterpay, the buy now, pay later service owned by Block Inc.’s Square, is the one most used by Gen Z consumers—those between 18 and 25 years old—according to a survey from Insights in Marketing, a marketing consultancy, with 58% of them having used Afterpay. Next was Klarna at 44%; Affirm …

Read More »Is BNPL Risk Overstated? New Data Suggests It Isn’t

One impression of consumers who use buy now, pay later services is that they may not be as financially literate as others. New data from Capterra, a software reviews and selection platform, indicate that picture may not be entirely accurate. In Arlington, Va.-based Capterra’s “2022 Buy Now, Pay Later Survey,” …

Read More »The CFPB Proposes to Publish Details on State or Local Enforcement Actions

The Consumer Financial Protection Bureau has become a much more active regulator of payments and other financial industries since the onset of the Biden Administration, and on Monday the agency lent further momentum to that trend. The 11-year-old federal agency is now asking for public comment on a proposal that …

Read More »Global Card Networks Are Thriving, Though Domestic Systems Could Pose a Threat

The number of card-accepting merchant locations around the world reached a record high of 88 million in 2021, up 2% over 2020 as measures to fight the pandemic helped stoke consumer usage of payment cards rather than alternatives like cash, according to research released Monday by London-based research firm RBR. …

Read More »COMMENTARY: How Banks And Credit Unions Can Create a Top of Wallet Experience for Consumers

As the holiday season continues and the cost-of-living rises, shoppers are searching for meaningful yet budget-friendly gifts for loved ones. Consumers need financial flexibility to make large purchases without using their entire paycheck to do so. Buy now, pay later solutions continue to rise in popularity as consumers search for …

Read More »