The national legal battle over an Illinois interchange law continues to broaden in scope. Several national organizations representing merchants are expected to file amicus briefs with the United States District Court for the Northern District of Illinois Friday in support of the Illinois Interchange Fee Prohibition Act. The briefs are …

Read More »Research Pins Down How Soon Real Time Payments Will be Routine

With the Federal Reserve’s FedNow service having debuted in July last year and The Clearing House Payments Co.’s RTP network in operation since 2017, just how soon can the U.S. payments industry expect widespread, routine exchange of real-time transactions? Answers to that question are beginning to emerge. According to a …

Read More »The Plot Thickens Over the Legal Challenge To Illinois’s Interchange Law

The battle over the Illinois Interchange Fee Prohibition Act has taken a huge new turn. Early Thursday, the Illinois Attorney General’s Office filed a motion with the United States District Court for the Northern District of Illinois’s Eastern Division challenging an Amicus brief from the Office of the Comptroller of …

Read More »PayPal Updates Its User Agreement to Collect More Personalized Information

Beginning next summer, PayPal Holdings Inc. will begin sharing more personalized shopper information with merchants, as outlined in its recently updated PayPal Privacy Statement. Data such as products, preferences, sizes, and styles will be shared with merchants to “help improve your shopping experience and make it more personalized for you,” …

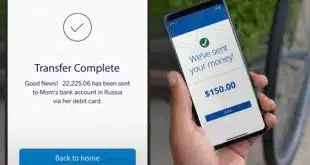

Read More »Two P2P Payments Providers Clear up What ‘Unauthorized’ Means

A fresh report from Consumer Reports finds that two of the four peer-to-peer payments companies it evaluated have cleared up the definition of “unauthorized” transactions pertaining to fraud. The publication last reviewed Apple Cash, Cash App, Venmo, and Zelle in 2022. The issue of what is an unauthorized P2P transaction gained …

Read More »Strava Teams With Cash App and other Digital Transactions News briefs from 9/27/24

Strava, an online community for athletes, said it is working with Block Inc.’s Cash App unit to launch this year’s HBCU Homecoming Tour, which features running events at U.S. universities. The Consumer Financial Protection Bureau is reportedly seeking comment on Apple Inc.’s practices with respect to contactless payments as the regulator works on …

Read More »Consumers Strongly Support Illinois Interchange Law, Proponents Say

The Illinois Retail Merchants Association released a survey late Wednesday showing that voters in the state support the Illinois Interchange Fee Prohibition Act passed earlier this year. The survey comes hard on the heels of a lawsuit filed last month by several organizations representing banks and credit unions challenging the …

Read More »Combatants Take Up Their Positions in Reaction to the DoJ’s Antitrust Suit Against Visa

Reaction from the payments industry to the Justice Department’s announcement Tuesday that it is suing Visa Inc. over antitrust issues involving its debit card business was swift and pointed. As expected, representatives of the payments industry denounced the lawsuit as baseless, while representatives of the merchant community and legislators friendly …

Read More »The Government’s Lawsuit Gets Into the Weeds on How Visa Built And Maintains Its Debit Empire

The U.S. Department of Justice’s 71-page complaint accusing Visa Inc. of monopolizing U.S. debit networks goes into great detail about the company’s pricing strategies and attempts to get merchants and card issuers to direct their debit business toward Visa. Those efforts have been quite successful. Referring to Visa’s so-called “moat” …

Read More »The Justice Department May Haul Visa Into Court Over Debit Card Issues

The biggest question the payments industry is wrestling with this week is whether the U.S. Department of Justice is about to sue Visa Inc., apparently over debit card issues. The financial wires were abuzz with speculation Tuesday morning that the DoJ could file an antitrust lawsuit before the day is …

Read More »