Same-day ACH payment volume topped 1.2 billion payments in 2024, said Nacha, the automated clearing house rule maker, and was valued at $3.2 trillion. Nacha said same-day ACH volume increased 45.3% from 2023 to 2024. Overall, ACH Network payment volume rose 6.7% from 2023 to 2024, to 33.6 billion payments in …

Read More »Opponents of the Illinois Interchange Law Hedge Their Bets With Legislation To Repeal It

A bill was introduced late Tuesday in the Illinois House of Representatives seeking to repeal the Interchange Fee Prohibition Act. The legislation, introduced by Rep. Margaret Croke, chairperson of the House Financial Institutions and Licensing Committee, is the latest twist in an ongoing battle over the IFPA, which became law …

Read More »How Mega Data Breaches Dominated in 2024

2024 was the year of the mega-data breach, with six breaches accounting for 85%, or 1.4 billion, of the 1.7 billion breach notices sent to victims in 2024. That’s according to The Identity Theft Resources Center’s annual Data Breach report, released early Tuesday. At least 100 million breach notices were …

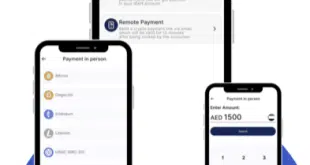

Read More »Codego Launches Gateway Software While KuCoin Looks to Recover From Its Legal Woes

The fintech Codego Ltd. has launched its Cryptogateway software, which enables merchants in 33 countries to accept cross-border in-person and e-commerce transactions in cryptocurrency and receive the funds in fiat money in an IBAN account. IBAN accounts are typically used to hold funds arising from cross-border transactions. The new service, which works …

Read More »XMoney Signs Visa as Partner and other Digital Transactions News briefs from 1/28/25

X, the social media platform formerly known as Twitter, appears to have signed a deal with Visa Inc. for the card brand to be a partner in XMoney Account, the platform’s possible payments service, reported CNBC.com. Fuel discount platform GasBuddy launched its Pay with GasBuddy+ card issued by Fifth Third Bank N.A. bearing the …

Read More »Maryland Is the Latest Batter to Take a Swing at Regulating Interchange on Sales Tax and Tips

The Maryland legislature held a hearing late Tuesday on a bill prohibiting interchange from being charged on sales tax and gratuities linked to credit and debit card transactions. The bill, introduced by Delegates Todd Morgan and Brian Crosby, is the latest in what is expected to be a flurry of …

Read More »Deluxe Debuts dlxPAY and other Digital Transactions News briefs from 1/21/25

Deluxe Corp. launched dlxPAY, a mobile app that offers merchants a suite of features, including real-time transaction management, advanced security, and customizable notifications, to give them more insight into their payment processing. The app also is compatible with the Ingenico Moby 5500 point-of-sale device. Two trade associations have sued the Consumer Financial …

Read More »AmEx Settles With The DoJ Over Deceptive Marketing Practices; Shift4 Fined By The SEC

American Express Co. reached an approximately $230 million settlement with the Department of Justice late Wednesday over allegations the card company engaged in deceptive marketing practices. The DoJ claims that AmEx’s deceptive marketing practices for its credit card and wire transfer products violated the Financial Institutions Reform, Recovery and Enforcement …

Read More »Chargebee Notes Click to Cancel Compliance and other Digital Transactions News briefs from 1/17/25

Recurring payments specialist Chargebee said its Retention product is in compliance with the Federal Trade Commission’s Negative Option rule, or click to cancel rule. That rule intends to make canceling a subscription as easy as the sign up process among other stipulations. Jupiter Payments said Get Honest Solutions, an independent sales organization that used …

Read More »Block Agrees to Pay CFPB Fines Over Cash App’s Alleged Sloppy Fraud Prevention

Block Inc. reached an agreement with the Consumer Financial Protection Bureau early Thursday under which it will pay up to $175 million in restitution for what the CFPB claims were sloppy and misleading fraud-prevention practices used by Block’s Cash App. Under the terms of the agreement, Cash App has agreed …

Read More »