Gateway Funnel Pros, an alternative payment gateway specialist for merchants selling high-risk, regulated, or restricted products, has launched a payment gateway and merchant-account services for WooCommerce merchants selling health and wellness products, such as supplements, that some gateway providers may consider to be high-risk products. The integration will enable WooCommerce …

Read More »Is 2025 Going to Be the Year of the Stablecoin?

As 2025 begins to unfold, some experts and network providers are beginning to think the year could see a breakthrough for stablecoins, the digital currency generated by a blockchain but with a value tied to a national currency, such as the dollar. That link allows users to deploy digital dollars, …

Read More »Transcore’s West Virginia Toll Deal and other Digital Transactions News briefs from 1/15/25

Transcore announced it has activated its Infinity tolling technology on the West Virginia Turnpike. The payments platform ePayPolicy announced Quotes and Invoices, a service intended to help insurance companies guide customers from an initial quote to invoice and payment. Payments-software provider Eastnets announced it has achieved compliance with the European Union’s Digital Operational Resilience Act, …

Read More »A CFPB Study Weighs in on the Buy Now, Pay Later Trend

Consumers with subprime or deep subprime credit scores accounted for the majority of buy now, pay later originations from 2021 to 2022, a report by the Consumer Financial Protection Bureau finds. Within those two subsets, 45% of BNPL loans during that period were taken out by consumers with deep subprime …

Read More »Expecting A CCCA Revival, Opponents Spell Out the Bill’s Economic Impact

Opponents of the proposed Credit Card Competition Act expect the bill will be reintroduced in Congress, so the Electronic Payments Coalition launched a pre-emptive strike late Wednesday with a report detailing the bill’s potential economic impact. The study, conducted by Oxford Economics Research, claims the CCCA’s impact on the U.S. …

Read More »The CFPB Picks FDX for Oversight of U.S. Open Banking Standards

The Consumer Financial Protection Bureau said Thursday U.S. open-banking standards will be developed under the aegis of Financial Data Exchange Inc., a standards-setting body. The CFPB recognized FDX as the standard-setting body under the bureau’s Personal Financial Data Rights rule. The final version of that rule was released in October, …

Read More »CFPB Sues Experian and other Digital Transactions News briefs from 1/8/25

The Consumer Financial Protection Bureau sued credit reporting agency Experian over claims it unlawfully failed to properly investigate consumer disputes. In a statement, Experian says the lawsuit is without merit. “It is contrary to longstanding regulatory and judicial precedent and is another example of irresponsible overreach by the CFPB. Our legal position …

Read More »X9 Issues QR Code Standard and other Digital Transactions News briefs from 1/7/25

The Accredited Standards Committee X9 Inc. has published a standard, “QR Code Protection Using Cryptographic Solutions, X9.148,” laying out how to create secure QR codes. Nuvei Corp. announced it will provide payments processing in a partnership with GIG, a technology company specializing in the iGaming business. Paysafe Ltd. has won approval from the …

Read More »PayPal Faces Discrimination Lawsuit and other Digital Transactions News briefs from 1/6/25

An Asian-American businesswoman named Nisha Desai has sued PayPal Holdings Inc. on grounds of racial discrimination, alleging the company restricted some of a $535-million investment commitment to Black and Hispanic candidates. The suit, filed in U.S. District Court for the Southern District of New York, asks for unspecified damages and an order …

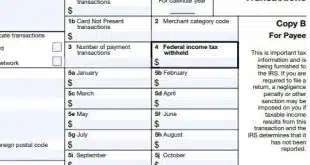

Read More »The IRS Rings in 2025 With New Reporting Requirements for P2P Networks

The Internal Revenue Service will begin requiring peer-to-peer payment apps in 2025 to issue 1099-K statements to self-employed workers who received more than $5,000 in payments through those apps in 2024. The new requirement, which is being implemented after a two-year delay, applies to such P2P apps as PayPal, Venmo, …

Read More »