The Hale & Hearty Soups fast-casual chain of 20 locations in Boston and the New York City area has chosen Appetize Technologies Inc. to upgrade its point-of-sale operations. The deployment is expected to conclude next month.With consumers worldwide reluctant to travel by air because of fears of catching Covid-19, some 78% of …

Read More »Fast Woos WooCommerce and other Digital Transactions New briefs from 12/14/20

Online checkout provider Fast AF Inc. said its service is now available to 4 million e-commerce stores on the WooCommerce platform. Earlier this year, Fast received $20 million from investors, including Stripe.Spending on entertainment decreased for the week ending Dec. 6, compared to the week ending Dec. 8, 2019, with a 23.9% drop in debit …

Read More »Fiserv Adds Its 500th Financial Institution to Zelle and other Digital Transactions News briefs from 12/10/20

Fiserv Inc. said CB&S Bank is the 500th financial institution added to the Zelle network via the processor. Zelle is the person-to-person payments service from Early Warning Services LLC.DaVinci Payments and North Lane Technologies (formerly Wirecard North America) jointly announced the completion of a previously announced merger. The combined business will operate …

Read More »P97 Networks Partners With Cybersource to Expand Mobile Payments at the Pump Globally

Houston-based P97 Networks Inc., a provider of cloud-based mobile-commerce technology, including pay-at-pump, has partnered with Cybersource, Visa Inc.’s fraud-management platform, to expand its PetroZone platform offering to fuel retailers both in North America and overseas. P97 has installations in 140 countries. PetroZone is an EMV-compliant application that enables mobile payment …

Read More »COMMENTARY: The DoJ Is Right in Suing To Stop Visa’s Deal For Plaid. Here’s Why (Part II)

Unlike Visa and Mastercard, Plaid is not just another credit and debit card company largely beholden to the big banks. It uses modern technology, in a sector that has been slow to adopt it, to create a new payments paradigm. It likely has no plans to issue cards or use …

Read More »COMMENTARY: The DoJ Is Right in Suing To Stop Visa’s Deal For Plaid. Here’s Why (Part I)

Finally! No doubt, merchants throughout the country are applauding the Justice Department’s suit against Visa to stop its planned acquisition of Plaid, a potential competitor. For far too long, we’ve witnessed the growth of Visa’s dominance of the debit card business, which has come at a huge cost to America’s …

Read More »ATM Operators Praise a Proposed OCC Rule That Would Wipe Away Years-Old Regulatory Roadblocks

Independent ATM operators are lauding a proposed rulemaking from the federal Office of the Comptroller of the Currency they say would correct a history of denial of access to banking services for entrepreneurs that install and operate ATMs in retail stores and other locations. Observers say the rulemaking, if adopted, …

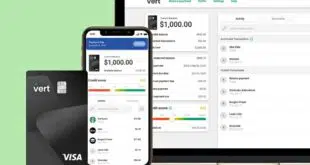

Read More »XTM Announces an Unsecured Visa Card With a Dynamically Determined Credit Line

Credit cards historically have either been secured by a deposit or tied to a credit limit that remains fixed over time. On Friday, a Toronto-based payments-technology provider announced it is developing an unsecured card that comes with a credit line that varies with cardholder behavior. The Visa-branded Vert card, managed …

Read More »Why Regulators Are Saying ‘Yes’ to Mastercard-Finicity But ‘No’ to Visa-Plaid

Visa Inc. may be stymied for the time being in its quest to enter the increasingly crucial data-networking business, but its archrival Mastercard Inc. now expects to become a key player in that arena by the end of the year. That’s when the number-two card network says it will close …

Read More »Chase Adds BNPL Option and other Digital Transactions New briefs from 11/16/20

JPMorgan Chase & Co. is the latest to join the buy now, pay later trend with “My Chase Plan,” which allows holders of Chase consumer credit cards to pay off purchases over time with no interest. A monthly fee applies.Debit card use in mobile wallets soared 58.6% for the week ending …

Read More »