International payments provider Klarna Bank AB acquired Inspirock, an online trip planner used by 25 million customers annually. Terms were not disclosed.In related news, Klarna said it is working with software-as-a-service platform provider Wix.com Inc. to enable Wix’s e-commerce merchants in 17 countries to accept payments through Klarna.Processor Lightspeed Commerce Inc. expanded its Lightspeed Capital program …

Read More »Veem Partners With Q2 Holdings to Make Digital B2B Payments More Accessible

As part of its strategy to remove friction from the accounts-payable and accounts-receivable process for small and medium-size businesses, payment-technology provider Veem Inc. on Thursday announced a partnership with Q2 Holdings, Inc., a provider of digital banking and lending solutions. Under the terms of the deal, Veem will make its …

Read More »Stripe Strikes Again In Executing Its Strategy to Expand Beyond Online Payments Acceptance

Building on its strategy of expanding beyond payments acceptance, Stripe Inc. on Wednesday announced the acquisition of Recko Inc., a provider of payments-reconciliation software for Internet businesses. Terms were not disclosed. The deal follows the debut of new applications this year intended to carry out this strategy, such as Stripe …

Read More »How Consumers’ Growing Adoption of BNPL Is Getting the Ad Dollars Flowing

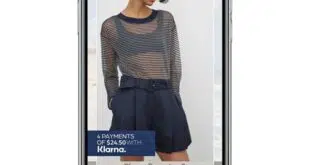

The heady times for buy now, pay later just keep on rolling. Now, with 44% of consumers saying they have used BNPL options to make a purchase, according to personal-finance company Credit Karma LLC, providers of the point-of-sale financing have opened the ad-spending spigot. A new report from MediaRadar, a …

Read More »B2B and Health-Care Payments Help Drive a Robust Quarter for the ACH

Driven by a surge in business-to-business and health-care claims payments, transactions on the nation’s automated clearing house network swelled 7.7% year-over-year in the third quarter, according to Nacha, the organization that governs the network. Transactions totaled 7.3 billion, up by 520 million, while dollar volume totaled $18.1 trillion, a 13/8% …

Read More »Paysafe Relaunches its Partner Program and other Digital Transactions News briefs from 10/19/21

Paysafe Ltd. said it relaunched its U.S. partner program for independent sales organizations, independent software vendors, and financial institutions.Anaheim Arena Management, manager of the Honda Center in Anaheim, Calif., has selected SpotOn Transact Inc.’s Appetize unit to manage all concessions through cloud technology. The move comes in advance of the new National Hockey …

Read More »Fiserv Acquires BentoBox and other Digital Transactions News briefs from 10/18/21

Fiserv Inc. announced the acquisition of BentoBox, a specialist in online restaurant platforms and technology. BentoBox serves more than 14,000 restaurant locations. Terms were not disclosed.Mindbody, a payments and technology platform for the fitness industry, announced it has closed on its acquisition of ClassPass, a monthly subscription service also focused on …

Read More »Bakkt Acquisition a Step Closer and other Digital Transactions News briefs from 10/15/21

VPC Impact Acquisition Holdings, a special-purpose acquisition company, announced its shareholders approved VPC’s acquisition of Bakkt, thus taking the digital-asset marketplace public.Payments-technology provider Worldnet Payments said it is the first integrated payments platform to complete a Level III EMV and contactless certification of Ingenico’s Self Series of devices. Ingenico is a unit of Worldline S.A.Payments …

Read More »The U.K.’s SumUp Busts Into the U.S. Acquiring Market With Its Deal for Fivestars

In a deal that could have important implications for payments providers like Square Inc. and Stripe Inc., the United Kingdom’s SumUp Inc. early Thursday announced it has acquired Fivestars Loyalty Inc., a San Francisco-based payment facilitator for some 12,000 small businesses. The acquisition, SumUp’s first in the U.S. market, calls …

Read More »ZmBIZI’s Tap-to-Pay Smart Phone Released and other Digital Transactions News briefs from 10/14/21

ZmBIZI LLC released its Z2 smart phone that accepts tap-and-pay transactions without requiring an external POS terminal. The $550 smart phone was part of a Visa Tap to Phone test earlier this year and is expected to have full commercial availability in early 2022.Visa Inc.’s U.S. Spending Momentum Index fell for the second consecutive month, …

Read More »