Payments provider Repay Holdings Corp. closed on its $503-million cash-and-stock acquisition of BillingTree, an 18-year-old payments-technology provider. The deal, the largest in Repay’s history, was announced May 10.NCR Corp. said it expects to close its $2.5-billion acquisition of ATM-network specialist Cardtronics plc on June 21. The merger agreement was announced in January.Freight-payments provider PayCargo received a $125-million Series …

Read More »With GoDaddy Payments, Web Impresario GoDaddy Starts Building on Its Poynt Deal

The first fruits of GoDaddy Inc.’s acquisition six months ago of payments-technology provider Poynt Inc. emerged Tuesday with the announcement of GoDaddy Payments, a service aimed at unifying payments capabilities for GoDaddy’s base of e-commerce clients. To start with, GoDaddy Payments will focus on e-commerce transactions for clients using GoDaddy Websites …

Read More »Kabbage Checking Debuts and other Digital Transactions News briefs from 6/15/21

American Express Co. said its Kabbage unit now offers Kabbage Checking to U.S. small businesses. AmEx also said it now offers Kabbage Funding to small businesses with lines of credit ranging from $1,000 to $150,000.Global Payments Inc. has launched a point-of-sale application that operates on commercially-available, off-the-shelf mobile phones, reported The Paypers …

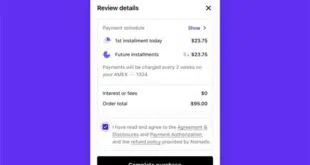

Read More »Shopify And Affirm Open Buy Now, Pay Later to U.S. Sellers Via Shopify Installments

With e-commerce sales booming, payments players are looking for combinations that can keep online customers engaged and add even more buyers to their ranks. An example emerged Thursday morning as Shopify Inc. and Affirm Inc. announced Affirm’s buy now, pay later service is now available to “hundreds of thousands” of U.S. …

Read More »Uplift’s BNPL Bet on Vegas.com and other Digital Transactions News briefs from 6/10/21

Buy now, pay later provider Uplift Inc. said its service has been integrated with Vegas.com, a travel site.In related news, buy now, pay later provider Splitit said its service is now available on the ChargeAfter platform, which offers merchants a variety of consumer financing methods.Mastercard Inc. said it has closed on its $850-million acquisition of Ekata …

Read More »U.S. Consumer Spending Capped a Year-Long Recovery With a Strong May Reading, Visa Says

Consumer spending has now been recovering for a full year from the impact of Covid-19, according to a report released on Wednesday by Visa Inc. The card network’s U.S. Spending Momentum Index, which it began releasing publicly last month, registered a reading of 123.3 for May. That number indicates 59% …

Read More »86% Abandon Shopping Carts and other Digital Transactions News briefs from 6/9/21

A survey from Fast, an online checkout provider, found that 86% of U.S. shoppers have abandoned an online shopping cart. Of the 1,004 consumers surveyed earlier this month, 55% said they would be more likely to make an online purchase if there was a quicker, easier way to buy directly from …

Read More »Eye on Mobile: Keys And IDs Come to Apple Wallet, And Google Pay Pulls Into ParkMobile

One way to boost mobile-wallet usage for functions like payments is to more tightly integrate the apps into users’ daily lives. Apple Inc. followed that script with its preview on Monday of an update for watchOS8, the brains behind its Apple Watch. This fall, the refresh will allow users to …

Read More »Lightspeed’s Latest Acquisitions Position the Processor to Become An Omnichannel Platform

As part of its strategy to create an all-encompassing platform for merchants and their suppliers, Lightspeed POS Inc. on Monday announced the acquisition of two companies: Ecwid Inc., a consumer e-commerce platform, and NuOrder Inc., an e-commerce platform for suppliers, for a combined $925 million in cash and equity in …

Read More »SpotOn’s Sidekick Debuts and other Digital Transactions News briefs from 6/7/21

Point-of-sale developer SpotOn introduced SpotOn Sidekick, a handheld POS-acceptance device designed specifically for food trucks, pop-up dining, cafes, and other mobile food kitchens. Pricing was not disclosed.Visa Inc. said banking giant Goldman Sachs will deploy Visa’s B2B Connect and Visa Direct Payouts platforms to speed cross-border business-to-consumer and business-to-business payments for Goldman client …

Read More »