Payments provider FreedomPay has added support for Google Pay, enabling Google Pay users to make e-commerce payments in Android apps and in Web browsers. This can be done on a merchant’s Web site regardless of browser or operating system or within an Android app, with FreedomPay securely integrating to the Google Payments …

Read More »Stripe, Prepaid Card Providers Try to Capitalize on Pandemic-Spawned Opportunities

They say that in every crisis there’s an opportunity. E-commerce merchant processor Stripe Inc. and several providers of prepaid accounts think they’ve found some in the Covid-19 pandemic sweeping the globe. San Francisco-based Stripe announced Thursday it had raised another $600 million in an extension of its Series G funding …

Read More »Moderation in Sales Trends Emerges in E-Commerce and Among Small Businesses

Two reports analyzing sales at e-commerce merchants and small businesses during the Covid-19 pandemic indicate moderation in some categories may be happening. Many categories among e-commerce merchants moved a few percentage points for the week of April 7-13, according to the Covid-19 Weekly Pulse Report for E-commerce from San Jose, …

Read More »Stripe Raises $600 Million and other Digital Transactions News briefs from 4/16/20

Saying the Covid-19 pandemic “is pushing the economy online,” e-commerce payment processor Stripe Inc. announced it has raised another $600 million through an extension of its Series G funding round. Stripe said it will use the funding “to step up product development, global expansion, and strategic initiatives.”Payments provider Clearent launched Clearent EDU, a free …

Read More »BofA Reports Booming Zelle Numbers as America Copes With Stay-at-Home Policies

If the first quarter of the year is any indication, person-to-person payments might be getting a big lift as stay-at-home consumers look for safe ways to pay in the face of the Covid-19 outbreak. Bank of America Corp. reported Wednesday transactions on its Zelle platform shot up 76% compared to …

Read More »Pandemic Hits U.S. Bancorp’s Merchant Revenues and Raises T&E-Related Expenses

U.S. Bancorp’s big payments operation that includes merchant acquirer Elavon Inc. is usually a reliable revenue generator, but the bank-holding company’s exposure to the big downturn in travel-and-entertainment and business spending because of the Covid-19 pandemic became evident in the first quarter. Merchant payment volume declined 4.8% to $104.7 billion …

Read More »March Retail Sales Fall 8.7% and other Digital Transactions News briefs from 4/15/20

U.S. retail sales for March decreased 8.7% from February, according to figures released by the Census Bureau. One bright spot was a 28% increase in sales at food and beverage stores from March 2019. Clothing and clothing accessories store sales were down 50.7%.Fidelity National Information Services Inc. (FIS) said it is supporting …

Read More »Chase’s Merchant Volume Rose 5% Despite a ‘Tale of Two Cities’ First Quarter

JPMorgan Chase & Co., parent company of the nation’s biggest bank-owned merchant acquirer, managed to pull off a 5% increase in processing volume in the first quarter despite the restrictions on economic activity that took force in many states in the second half of March to control the Covid-19 pandemic. …

Read More »Eye on Online Ordering: Smaller Tech Players Aim at Smaller Eateries Impacted by Covid-19

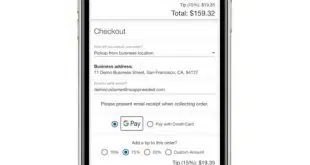

With restaurants in most major markets across the country forced to shut down on-premise dining because of the Covid-19 outbreak, online ordering, takeout, and delivery services are suddenly in the spotlight as local restaurants and other small, independent establishments grasp at technology to stay alive. That’s an immediate opportunity for …

Read More »eBay Names Walmart Exec as New CEO and other Digital Transactions News briefs from 4/14/20

EBay Inc. named former Walmart Inc. executive Jamie Iannone chief executive officer, effective April 27. Iannone, who will succeed interim CEO Scott Schenkel, most recently served as chief operating officer of Walmart eCommerce and was at one time chief executive of SamsClub.com. EBay indicated earlier this year it has plans to …

Read More »