Payments provider NMI LLC announced Thursday the launch of NMI Payments, a modular embedded-payments solution that enables software companies and independent sales organizations to integrate and accept payments online, in-store, in-app, through mobile devices, and at unattended payment terminals, according to the company. NMI Payments integrates within existing applications and …

Read More »Toast Reports a Robust 2023 And Fourth Quarter As Dining Maintains Its Rebound

Shares in restaurant point-of-sale specialist Toast Inc. were trading modestly up early Friday following the company’s release late Thursday of December-quarter and full-year results indicating double-digit increases in client locations and payments volume and offering further evidence of the hospitality industry’s recovery from the 2020 pandemic. The results came as …

Read More »Smaller Issuers Have Better Rates, CFPB Says and other Digital Transactions News briefs from 2/16/24

The Consumer Financial Protection Bureau’s most recent analysis of card issuing practices found that in the first half of 2023 small banks and credit unions tended to offer lower interest rates than the top 25 issuers. For consumers with scores between 620 and 719, the median annual percentage rate for a large …

Read More »Booming Same-Day ACH Volume Is Up 22%

Volume for automated clearing house transactions cleared and settled on the same day they’re initiated increased 22.3% in 2023, signaling the embrace of same-day ACH by the payments industry, Nacha says. Same-day processing was launched nearly eight years ago. Nacha, a rulemaker for the ACH network, says overall ACH volume …

Read More »If Top Card Execs Must Testify, So Should Merchant Leaders, CCCA Opponents Argue

Days after Sen. Dick Durbin, D-Ill., sent letters to the chief executives of Visa Inc. and Mastercard Inc. demanding they testify before the Senate Judiciary Committee about their opposition to the Credit Card Competition Act, the Electronic Payments Coalition is asking why the committee is not requesting that leaders of …

Read More »Shift4’s AI-Based Site Builder And Other Digital Transactions News briefs from 2/15/24

Shift4 Payments Inc. launched SkyTab Website Builder, a tool enabling restaurants to more easily design a Web site. Businesses using Shift4’s SkyTab point-of-sale payments technology can access the new service for free. Blackhawk Network announced Select Codes, which businesses can send to customers to enable access to prepaid gift cards. Bank of …

Read More »FIS’s Pay by Bank Path And Other Digital Transactions News briefs from 2/14/24

FIS Inc. said it is working with Banked, an open-banking provider, to develop new pay by bank services for businesses and consumers. Gateway provider Trice Technologies Inc. said it is a technology provider and real-time payments gateway for the RTP network from The Clearing House Payments Co. LLC. Web services and payments provider GoDaddy …

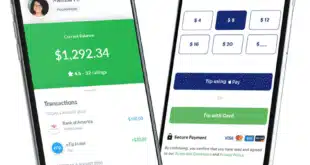

Read More »eTip Brings Digital Tipping To Davidson Hospitality Properties

The digital-tipping provider eTip announced late Monday it has partnered with Davidson Hospitality Group to make its service available to Davidson’s 85 hotels and resorts, as well as the company’s more than 200 restaurants, bars, and lounges in the United States. To initiate a payment through eTip’s application, consumers scan …

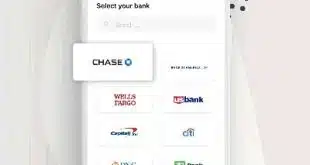

Read More »Radial Adds Link Money’s Pay by Bank for Account-to-Account Payments

E-commerce platform Radial Inc. is giving its merchants a new payment option that bypasses traditional credit and debit card payments and instead relies on account-to-account transfers. Dubbed Pay by Bank, the service was developed by Link Financial Technologies Inc., which does business as Link Money, an open-banking platform. King of …

Read More »Visa Adds Virtual Card Capabilities for Commercial Card Users

Just as Visa Inc. is expanding its Commercial Pay service to the Latin American and Caribbean region, it is making virtual card issuance for its commercial card clients a reality. Visa says Commercial Pay clients, which have access to a host of B2B payment services, now can add virtual corporate …

Read More »