Independent sales organizations can’t do much without a sponsor bank, also known as an acquiring bank, to get them access to the payment card networks. As with most business endeavors, the complexity of finding a sponsor bank has increased. It’s a challenge that attendees at the 2023 Midwest Acquirers Association …

Read More »Discover’s Q2 Financial Snapshot: Not as Robust as a Year Earlier

Discover Financial Services late Wednesday reported net income of $901 million for the second quarter of 2023, down 18% from a year earlier. Credit card loans for the quarter totaled $94 billion, a 19% year-over-year increase. As part of its earnings statement, Discover stated that “the comparative prior quarter ended …

Read More »It’s Official: FedNow Launches With 35 Banks And Credit Unions Signed up For Instant Pay

The Federal Reserve’s instant-payment service, FedNow, is officially live with 35 banks and credit unions participating, the nation’s banking regulator announced early Thursday. The launch, which culminates four years of work since the Fed first announced its intention to build a real-time payments rail, comes as the payments industry moves …

Read More »Relay Payments’ Latest Integration And Other Digital Transactions News briefs from 7/20/23

Relay Payments, a payments platform for the trucking industry, announced an integration with McLeod Software, a vendor of management software for the same industry. ACI Worldwide Inc. introduced an acquiring-as-a-service platform in collaboration with Dock, a Brazil-based technology company. The product is aimed at retailers, restaurants, and e-commerce businesses. Consumer attitudes …

Read More »FedNow’s Launch Is ‘Imminent’ As Observers Prepare for a New Age in Faster Payments

The Federal Reserve could launch its FedNow real-time payments service as early as tomorrow, sources tell Digital Transactions News. The network, which has been under development for nearly four years, represents the regulator’s first effort to create a nationwide network for instant payments, a service that other countries, and at …

Read More »Feedzai Launches Railgun, an AI-Based Fraud-Detection Engine

Risk-management technology provider Feedzai has harnessed artificial intelligence with the introduction of Railgun, its latest fraud-detection engine. What differentiates Railgun, according to Feedzai, is that it taps real-time data such as customer behavior patterns and the use of specific cards across merchant networks over longer periods of time. As a …

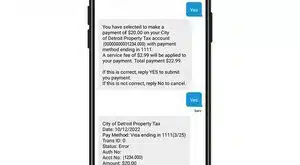

Read More »Eye on Text-to-Pay: DivDat Adds Text-to-Pay for Bill Payments; NMI Adds Authvia’s Text-to-Pay for its Portfolio

Two payments companies are tapping into consumers’ affinity for texting—more than 6 billion SMS text messages are sent daily, according to The Small Business Blog—with a bill-pay service and a program for merchants. First, Detroit-based Diversified Data Processing & Consulting Inc., known as DivDat, added a text-to-pay feature to its …

Read More »Keyo’s Hand Scanner Debuts And Other Digital Transactions News briefs from 7/19/23

Keyo, a provider of digital-identity technology, released its Keyo Wave+ hand scanner for payments, access control, ticketing, and other uses. Visa Inc. has renewed an agreement to be the exclusive payment-services provider for the U.S. Women’s and Men’s National Soccer Teams. Buy now, pay later provider Afterpay Ltd. said it has added “thousands” of new …

Read More »Consumers Want Simpler, Omnichannel Shopping and Payment Experiences, Fiserv Says

From ordering and payments to reward redemption consumers want a simpler shopping experience, according to research from Fiserv Inc. To meet demand, merchants and restaurants should provide more omnichannel experiences, retailer apps, and embedded payment options that add value. Buy online, pick up in store (BOPIS) is one way merchants …

Read More »Nuvei Expands Plaid Deal And Other Digital Transactions News briefs from 7/18/23

Payments provider Nuvei Corp. and open-banking specialist Plaid Inc. expanded their relationship to include new services, including bank-based payments for recurring payments and payouts, and new vertical markets, including utilities and business-to-business transfers. Synchrony said its Synchrony Pay Later service will be the exclusive buy now, pay later option at the At Home …

Read More »