The Federal Reserve could launch its FedNow real-time payments service as early as tomorrow, sources tell Digital Transactions News. The network, which has been under development for nearly four years, represents the regulator’s first effort to create a nationwide network for instant payments, a service that other countries, and at …

Read More »Feedzai Launches Railgun, an AI-Based Fraud-Detection Engine

Risk-management technology provider Feedzai has harnessed artificial intelligence with the introduction of Railgun, its latest fraud-detection engine. What differentiates Railgun, according to Feedzai, is that it taps real-time data such as customer behavior patterns and the use of specific cards across merchant networks over longer periods of time. As a …

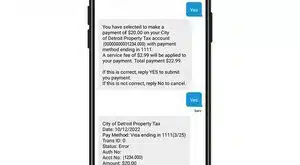

Read More »Eye on Text-to-Pay: DivDat Adds Text-to-Pay for Bill Payments; NMI Adds Authvia’s Text-to-Pay for its Portfolio

Two payments companies are tapping into consumers’ affinity for texting—more than 6 billion SMS text messages are sent daily, according to The Small Business Blog—with a bill-pay service and a program for merchants. First, Detroit-based Diversified Data Processing & Consulting Inc., known as DivDat, added a text-to-pay feature to its …

Read More »Keyo’s Hand Scanner Debuts And Other Digital Transactions News briefs from 7/19/23

Keyo, a provider of digital-identity technology, released its Keyo Wave+ hand scanner for payments, access control, ticketing, and other uses. Visa Inc. has renewed an agreement to be the exclusive payment-services provider for the U.S. Women’s and Men’s National Soccer Teams. Buy now, pay later provider Afterpay Ltd. said it has added “thousands” of new …

Read More »Consumers Want Simpler, Omnichannel Shopping and Payment Experiences, Fiserv Says

From ordering and payments to reward redemption consumers want a simpler shopping experience, according to research from Fiserv Inc. To meet demand, merchants and restaurants should provide more omnichannel experiences, retailer apps, and embedded payment options that add value. Buy online, pick up in store (BOPIS) is one way merchants …

Read More »Nuvei Expands Plaid Deal And Other Digital Transactions News briefs from 7/18/23

Payments provider Nuvei Corp. and open-banking specialist Plaid Inc. expanded their relationship to include new services, including bank-based payments for recurring payments and payouts, and new vertical markets, including utilities and business-to-business transfers. Synchrony said its Synchrony Pay Later service will be the exclusive buy now, pay later option at the At Home …

Read More »Eye on ISOs: Shift4 Adds to Its Sports Team Portfolio; PayBright Launches a Point-of-Sale Desk

Shift4 Payments Inc. continues to assert its position as a leading processor for sports teams and arenas. The Allentown, Pa.-based company announced Monday it will process ticket sales for the Florida Panthers of the National Hockey League through a partnership with SeatGeek, the Panthers’ mobile-based ticketing platform provider. The deal …

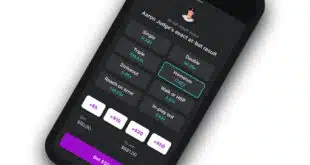

Read More »Two States Are Among the First Paysafe Will Serve Via the Betr Betting App

As online sports betting and iGaming continue to grow, Paysafe Ltd. has struck another deal with a betting app. Announced Monday, its agreement with Betr, a sports-betting app from social-media influencer Jake Paul, will serve Paysafe customers in Ohio and Massachusetts. Betr launched in Ohio in January and in Massachusetts …

Read More »Chopra in Talks with EC Counterpart And Other Digital Transactions News briefs from 7/17/23

The Consumer Financial Protection Bureau said informal discussions between Rohit Chopra, CFPB director, and Didier Reynders, commissioner for Justice and Consumer Protection of the European Commission, have started on a range of financial consumer protection matters, including the deployment of AI in decision making, BNPL products and their risks, consumer debt issues, …

Read More »Commentary: Five Years of Open Banking: Embracing a New Path Forward

Open banking, the system enabling seamless sharing of financial data via application programming interfaces between banks and third-party service providers, has captured global attention over the past several years. In 2018, the Second Payment Services Directive (PSD2) marked the official open-banking era by mandating data sharing in Europe. This milestone paved …

Read More »