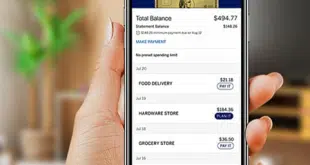

Issuer-provided installment plans, such as American Express Plan It, My Chase Plan, and Mastercard Installments, are on par in popularity with in-store installment offers, finds Auriemma Group’s The Payments Report. American Express Co. was among the first issuers offering its own buy now, pay later plan, having launched it in …

Read More »Discover Unveils Balance+ to Offer Overdraft Protection on Debit Cards

Consumers may be well acquainted with the concept of overdraft protection when writing checks, but early Monday Discover Financial Services said it is extending the service to its debit cards. Cardholders who hold the company’s Cashback Debit Checking account are eligible for the new service, called Balance+. “With Balance+ we …

Read More »Coinbase Wins a Federal Contract to Store Digital Assets

Cryptocurrency exchange and management provider Coinbase Inc. has won a $35.5-million contract to safeguard and trade digital assets on behalf of the U.S. Marshals Service. The Service, a unit of the U.S. Department of Justice, is responsible for asset forfeitures arising from federal legal cases, including cases that involve recovery …

Read More »Canadian Processor Helcim Looks to Draw More Partners With a Revenue Split

The Canada-based payments provider Helcim Inc., which like many processors works with a range of third-party partners, said late on Tuesday it is stepping up that collaboration to allow these integration partners to share in the company’s transaction revenue. Helcim figures revenue sharing will help attract yet more developers and …

Read More »How the Supreme Court Has Set up an Intense Struggle Over Sellers’ Debit Card Costs

Decisions from the U.S. Supreme Court are supposed to settle matters, but a verdict the high court delivered early Monday has the potential to stir up debit card pricing questions for some time to come, some observers say. The justices, in a 6-3 decision, ruled a case brought by a …

Read More »Contactless May At Some Point Include Functions Beyond Payment, the NFC Forum Says

Contactless transactions were supercharged by the pandemic, and now slightly more than half of U.S. cardholders are using the technology when they pay with either cards or wallets, according to Mastercard Inc. research. With that kind of momentum behind them, researchers are looking at ways to expand near-field communication technology, …

Read More »Nayax Readies EV CloudPay for Burgeoning Electric Vehicle Charging Payments

Payments and commerce platform Nayax Ltd. is tapping the cloud to enable its EV CloudPay service designed for payments at electric-vehicle charging stations. Announced Monday, EV CloudPay enables motorists to pay for EV charging with a credit card, debit card, or mobile wallet via a physical payment-processing kiosk at charging …

Read More »Tiptop Adds a New Twist to BNPL By Applying Trade-In Value to New Purchases

Tiptop Labs Inc., a payments-service provider, has launched a buy now, pay later program that allows consumers to trade in items for a credit toward a new purchase with select e-commerce merchants. The idea of applying trade-in value for a new purchase grew out of a trade-in-only app Tiptop launched …

Read More »What Would a Credit Card ‘Holiday’ Look Like?

In 1933, President Franklin Roosevelt shut down financial institutions for a week, called a “bank holiday,” to restore calm after a run on banks. This comes to mind after a federal judge recently indicated she won’t approve a settlement between the major card brands and merchants over the fees that …

Read More »U.S. Mobile Payments Volume to Reach $797 Billion in 2025 and other Digital Transactions News briefs from 6/28/24

Data from eMarketer, a research firm, indicates mobile payments at the point of sale in the U.S. market will total $670.5 billion this year, up 21.4% from 2023, and will grow nearly 19% to reach $797 billion in 2025. Volume will cross the $1-trillion mark in 2027, the firm predicts. SmartMetric …

Read More »