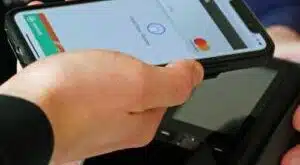

The recently developed ability to accept card payments on an ordinary smart phone, with no additional hardware, has electrified the payments industry. But the technology, known as SoftPOS, comes with complications that could slow progress, a panel of experts warned Thursday. SoftPOS, which as the name implies relies on specialized …

Read More »Gen Zers Lead the Charge as Canadians Embrace Mobile Debit Transactions

In-store debit card payments made using mobile devices in Canada surged 53% during the 12-month period ended July 31, compared to the same period a year earlier, according to Interac Corp., Canada’s national debit network. In addition, e-commerce transactions made using a mobile device increased 17% year-over-year during the same …

Read More »Sephora Is the First Client for J.P. Morgan Payments’ Tap to Pay on iPhone Service

Add Sephora, a beauty retailer, to the list of merchants adopting iPhones as payment-acceptance devices in the Tap to Pay on iPhone program. J.P. Morgan Payments says Sephora is its first such retailer to adopt the contactless-payment service, which does not require special hardware to complete a transaction. Announced Tuesday, …

Read More »Contactless And Mobile Wallets Are Gaining Ground Among Debit Users, a Pulse Study Finds

Consumer affinity for in-person transactions that reduce points of contact are taking hold as contactless payments made with debit cards swelled to 16% of the U.S. card-present share last year from 8% in 2021. It’s a similar story with debit cards used with mobile wallets. Their use increased from 5% …

Read More »Waffle House Goes Contactless And Other Digital Transactions News briefs from 8/14/23

The Waffle House restaurant system has adopted chainwide contactless payment capability, including mobile-wallet acceptance, through the Oracle Payment Cloud service. A startup called iWallet said it will adopt FedNow for mobile check deposits. The Federal Reserve launched the FedNow real-time payments service last month. MarginEdge, a bill-payments provider, launched a mobile bill-payment app for restaurant operators …

Read More »Tap to Pay Arrives for Venmo And PayPal Zettle

PayPal Holdings Inc. is adding tap to pay on mobile phones to its U.S. Venmo users with business profiles. The Tap to Pay on Android technology enables merchants that accept Venmo payments to do so using conventional Android smart phones without having to attach a special payment dongle. The service …

Read More »DoorDash Adds EBT Payments And Other Digital Transactions News briefs from 6/28/23

DoorDash announced a number of new features for its food-delivery app, including the ability to create multiple carts simultaneously and the addition of online payments funded by SNAP/EBT benefits. Alphabet Inc.’s mobile-payments app, Google Wallet, will reportedly begin supporting QR codes to trigger payments, starting in Brazil. The wallet has up to …

Read More »The NFC Forum Looks to Widen the Range for Contactless Payments

A significantly longer range for contactless transactions could be a reality in the market within the next two to five years, according to news released this week by the NFC Forum, the standards body for near-field communication technology. The current standard for contactless payments is five millimeters, or about one-fifth …

Read More »Plaid Beacon Debuts And Other Digital Transactions News briefs from 6/22/23

Open banking specialist Plaid launched Plaid Beacon, an anti-fraud network for fintechs and financial institutions. The fintech Karma Wallet has allied with card-issuing platform Marqeta Inc. to introduce a prepaid card offering cash-back rewards from merchants said to be local, ethical, and sustainable. PayEm, a spend-management platform, has integrated with American Express to allow …

Read More »A No-Contract Smart POS Terminal from Helcim Debuts

Helcim Inc., a Calgary, Alberta-based payments provider, launched its Helcim Smart Terminal, which it says carries no contract or monthly fees. The device, which uses the Android operating system, is priced at $349 (C$429) and will be available this summer. Among its technical capabilities is a built-in printer, a large …

Read More »