GoTab Inc., a provider of digital ordering and payment solutions for the hospitality industry, has introduced Pocket POS, a mobile point-of-sale terminal about the size of a mobile phone that enables servers to take orders, manage tabs, process payments, and communicate with hosts and hostesses, as well as kitchen staff, …

September, 2023

-

14 September

Cross-Border Options Are Among Factors Driving Real-Time Payments Growth, a Study Finds

A growing volume of cross-border transactions is fueling the development of real-time payment services, according to a new report from Bank of New York Mellon Corp. and research firm Datos Insights. The report also says businesses stand to lose if they’re slow to invest in real-time payments. Some 80% of …

-

14 September

FreedomPay’s Cross-Border Platform And Other Digital Transactions News briefs from 9/14/23

Commerce platform FreedomPay said it will begin offering point-of-sale devices from Pax Technology Inc. in the second quarter next year. Visa Inc. announced it will deploy its real-time payments network, Visa Direct, to allow users of United Kingdom-based money-transmission platform Paysend to route payments to eligible Visa cards in 170 countries and territories. …

-

13 September

Evolving your payments strategy for the new consumer experience

Steven Velasquez, Senior Vice President and Head of Partner Business Development – Elavon, Inc. Delivering payments that meet consumer demand As AI, ChatGPT, and the increased adoption of instant payments become more prevalent in our day-to-day lives, the impact of truly connected payments is upending the traditional consumer experience. The …

-

13 September

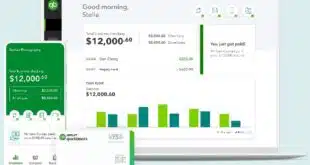

Intuit Makes a Bid for More Small-Business Payments With a New Combo Service

Intuit Inc., developer of the QuickBooks accounting software and related services for small businesses, embedded itself further into the payments business on Wednesday when it unveiled QuickBooks Money. The free product allows businesses to send invoices accepting payment choices including credit, debit, automated clearing house, PayPal, Venmo, and Apple Pay …

-

13 September

Shift4 Agrees to Process for Timeshare Rental Marketplace RedWeek.com

Shift4 Payments Inc. has reached an agreement to become the processor for timeshare rental and resale marketplace RedWeek.com. Under the terms of the deal, Shift4 will process RedWeek.com’s timeshare rental and membership transactions, handle direct customer billing and recurring payments, and manage chargebacks, fraud, and reporting capabilities. A competitor to …

-

13 September

Fitli Taps Usio And Other Digital Transactions News briefs from 9/13/23

Fitli, an independent software provider for fitness professionals, has selected Usio Inc. for payments processing. Prepaid card specialist Blackhawk Network has agreed to launch “Gift Card Malls” inside airport and casino shops operated by WH Smith North America. Three unnamed central banks are testing a method from international money-transfer platform Swift to enable interoperability …

-

12 September

PayPal Expands a Processing Agreement With Uber, While BitPay Supports PayPal’s Stablecoin

In an expansion of its existing processing relationship with PayPal Holdings Inc., ride-sharing technology provider Uber Technologies Inc. will begin making use of PayPal’s domestic debit network routing in the United States and other markets and enable Uber drivers to receive wages directly in their PayPal and Venmo wallets. PayPal …

-

12 September

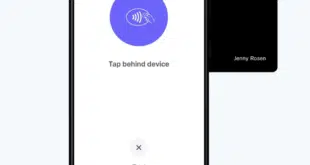

Eye on Processors: Wix Debuts Tap to Pay on Android; Adyen Issues 2 Billion Tokens

E-commerce platform Wix.com Ltd. looks to make it easier for its merchants with stores to accept physical payments with the debut of Tap to Pay on Android. The technology, coming from Stripe Inc., means merchants can accept contactless payments with a regular Android smart phone and no additional hardware. Tap …

-

12 September

PCI DSS 4.0 Compliance Concerns And Other Digital Transactions News briefs from 9/12/23

Some 90% of businesses are “concerned” about whether they will be able to meet a March 2025 deadline for compliance with PCI DSS 4.0, a newly updated payments-security standard, according to a survey from payments-security firm Bluefin and S&P Global Market Intelligence. The survey was conducted during the second quarter and included …