Alviere, a platform for embedded payments, has launched its Loyalty Wallets product, which features pay-by-bank functionality. The wallets can be funded by ACH transfer or direct deposit. Bank3, a community bank in Tennessee and Mississippi, has chosen Tyfone Inc.’s Instant Payment Xchange technology, meant to facilitate real-time payments on the FedNow system. The …

September, 2024

-

16 September

The Future of Checkout is Here: Android Based-AXIUM and SoftPOS for Frictionless Payments

Gone are the days of online-only shopping sprees. Consumers are flocking back to brick-and-mortar stores for many purchases. But this new breed of omnichannel shopper expects a seamless blend of the digital and physical experience. They’re accustomed to the power of technology – finding product information with a tap, comparing …

-

16 September

Crate & Barrel Teams With Adyen to Connect Its Offline And Online Sales Channels

Retail chain Crate & Barrel Holdings has partnered with Adyen NV to process payments for its 110 physical stores in the United States and Canada. The deal also covers processing for Crate & Barrel’s CB2 stores, a sister brand that sells modern furniture. Crate & Barrel will use Adyen’s unified …

-

16 September

Adyen Teams With Nayax to Support Digital Payments at EV Charging Stations

The Dutch processor Adyen NV and the Israel-based payments platform Nayax Ltd. announced early Monday they are teaming up to support digital payments for electric-vehicle charging stations around the world. The new agreement, which comes as electric vehicles become more numerous and raise a pressing need for more charging stations, …

-

16 September

Elo’s New Pay M100 Tablet and other Digital Transactions News briefs from 9/16/24

Elo Touch Solutions Inc. launched its Elo Pay M100 POS tablet, a mobile point-of-sale Android payments device aimed at restaurants as well as the general merchant market. Accessories include separate readers for mag-stripes and fingerprints. Kuvasz Solutions, a Chile-based payments services company formed in 2008, said it is expanding to the …

-

13 September

Rain Technology Launches an ATM Privacy Solution

Rain Technology, a provider a directional-display technology, has developed a solution that aims at reducing the risk of onlookers visually stealing a consumer’s PIN at an ATM. The solution, called ATM Switchable Privacy, enables as little as 0.2% of an ATM screen to be visible outside of a 45-degree viewing …

-

13 September

Worldline Replaces Its Longtime CEO As the Global Processor’s Shares Plummet

The big French processor Worldline SA announced early Friday longtime chief executive Gilles Grapinet will leave the company effective Sept. 30. The company says the search for a successor will evaluate candidates both inside and outside the company. In the meantime, the board has appointed Marc-Henri Desportes, deputy CEO since …

-

13 September

Alchemy Pay Adds BNN Chain Support and other Digital Transactions News briefs from 9/13/24

Cryptocurrency gateway Alchemy Pay said it now supports the BNB Chain blockchain ecosystem for developers working in the Web3 arena. Web3 is a vision of a blockchain-based web that includes cryptocurrencies, nonfungible tokens, and related entities. Co-branded credit card platform Cardless Inc. has appointed Joe Wold head of partnerships and Ailien Phan chief compliance …

-

12 September

Mastercard Beefs Up Its Cyber Defenses With Its Recorded Future Acquisition

Mastercard Inc. announced early Thursday it has acquired cybersecurity firm Recorded Future for $2.65 billion. The acquisition builds on Mastercard’s strategy of investing in fraud detection and cyber defense technologies, the network says. The deal also enhances Mastercard’s identity, fraud prevention, real-time decisioning, and cybersecurity services for merchants and financial …

-

12 September

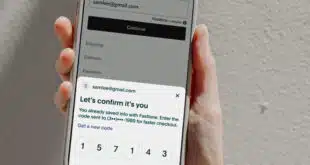

Eye on E-Commerce: Bold Adopts Fastlane; DNA Payments Launches Apple Pay Express

Fast on the heels of PayPal Holdings Inc.’s launch of its Fastlane service for online transactions, e-commerce platforms are eyeing the expedited-checkout technology. Some are acting. Bold Commerce early Thursday said its checkout routine has adopted Fastlane for the Adobe Commerce merchants it supports on its so-called headless-checkout platform. Headless …