Greenlight Financial Technology Inc. has partnered with Google Wallet to enable its debit card to be loaded into the Google Fitbit Ace LTE smart watch. The partnership is expected to help parents teach their children how to manage their spending and finances through Greenlight’s banking app, the company says. The …

August, 2024

-

7 August

How Global Payments Looks to ISVs, Payfacs, And M&A to Spur Growth

Global Payments Inc. remains invested in growing by acquisition, but it’s equally committed to growth via third-party agents such as independent software vendors and payment facilitators, its chief executive said early Wednesday as he reviewed his company’s June-quarter results and discussed its strategies in the two markets it straddles—issuing and …

-

7 August

Toast Sites Balloon 29% and other Digital Transactions News briefs from 8/7/24

Hospitality point-of-sale maker Toast Inc. said it now serves 120,000 merchant locations as of the end of the second quarter, a 29% increase from the same period a year ago. Its gross payment volume jumped 26% year-over-year to $40.5 billion. Toast posted second quarter revenue of $1.24 billion, a 27% increase from …

-

6 August

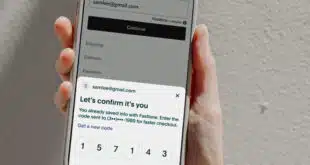

PayPal Rolls Out Its Fastlane Checkout Service for Online Sales

PayPal Holdings Inc. Tuesday announced its Fastlane By PayPal checkout service is now officially available to merchants of all sizes in the United States. PayPal began piloting Fastlane, which speeds guest checkout by allowing online shoppers to complete a purchase in one click, earlier this year with BigCommerce Inc. merchants. …

-

6 August

How FIS Is Banking on Bank Sales Post Worldpay

FIS Inc. isn’t quite the factor in merchant processing it once was, but the big Jacksonville, Fla.-based processor remains a significant factor in digital payments, specifically for banks, its top management was at pains to stress early Tuesday as the company reported its second-quarter results. “We’re very pleased with our …

-

6 August

Walgreens Adds Instacart Online SNAP and other Digital Transactions News briefs from 8/6/24

Drug store chain Walgreens announced it is enabling online SNAP/EBT payment acceptance via Instacart nationwide at more than 7,500 Walgreens stores, including more than 100 Duane Reade stores in New York. Most Walgreens locations already accept SNAP/EBT payments in store. Walgreens also added DoorDash Inc.’s SNAP/EBT acceptance earlier this year. In related news, Instacart also announced …

-

5 August

Bitcoin Depot Expands Its Merchant Network And Exceeds 8,000 Bitcoin ATMs

Bitcoin Depot Inc. has added more than 1,500 merchants across six more states to its BDCheckout program, which allows consumers to load cash into their Bitcoin Depot wallets at participating merchants. The expansion brings the number of BDCheckout merchants to 7,723 in 31 states. The new states into which Bitcoin …

-

5 August

Fiserv’s Small Business Index Improves in July But Restaurants Lag

Major payments providers have focused in recent years on signing and providing devices and services for restaurants, but that big bet may be taking at least a temporary beating, according to the latest Small Business Index from the big processor Fiserv Inc. The overall index, which is derived from Milwaukee-based …

-

5 August

NAB Rebrands as North and other Digital Transactions News briefs from 8/5/24

Payments provider North American Bancard has rebranded as North. The independent sales organization, which debuted in 1992, said North is emblematic of upward movement. Its values, business strategy, and merchant commitment stay the same, North said in a blog post. Nuvei Corp. said it will acquire Pay2All Instituição de Pagamento Ltda., a …

-

2 August

Eye on POS Technology: Grocer Adopts Instacart Smart Cart; Stinker Picks NCR Voyix

Another grocery chain is adding Caper smart shopping carts to its store, Instacart announced. Meanwhile, convenience-store chain Stinker Stores has adopted point-of-sale technology from NCR Voyix. San Francisco-based Instacart says Davis Food & Drug, which operates three stores in Utah, will replace most of its traditional shopping carts with Caper …