Mitek Systems Inc., a provider of identity-verification technology, is teaming up with DarkTower, the cyber-intelligence division of Davidson, N.C.-based IT consultancy Queen Associates, to combat account fraud and identity theft. The partnership grew out the increasing role criminal marketplaces on the dark Web are playing in account and check fraud, …

May, 2023

-

15 May

As FedNow Gears up for Launch, Processors Ready Smaller Clients

Jack Henry & Associates Inc., one of the earliest participants in the Federal Reserve’s nascent FedNow real-time payments platform, said early Monday it is “operationally ready” to support the service when it launches commercially in July. The Monett, Mo.-based processor said more than 20 client institutions are set to connect …

-

15 May

Fifth Third Closes on Big Data Deal And Other Digital Transactions News briefs from 5/15/23

Fifth Third Bancorp said it has closed on its acquisition of Big Data LLC, a technology platform for health-care payments. Terms were not disclosed Mark Barnett, president of Mastercard Inc. for Europe, said card interchange “represents incredibly good value” with respect to “sharing the costs and benefits of the payment system.” The remarks …

-

12 May

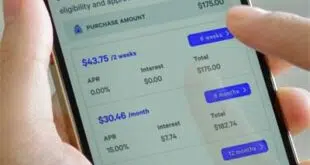

Eye on BNPL: Capchase Brings BNPL to SaaS Developers and Affirm’s Loss Broadens

Capchase, which provides funding to software-as-a-service companies without requiring them to give up an ownership stake, has launched a buy now, pay later financing option that allows SaaS vendors to collect the full contract value for their applications while providing customers with flexible payment terms. Capchase developed the BNPL payment …

-

12 May

COMMENTARY: Merchants Don’t Need Another Payment Option. They Need a Partner

Online merchants today are faced with a difficult dilemma. They often operate with limited resources, which is especially true for independent retailers with smaller budgets. To expand their businesses, these merchants must carefully manage their financial and human resources, especially in the highly competitive world of e-commerce. So, here’s a …

-

12 May

PAX Debuts Elys Workstation and other Digital Transactions News briefs from 5/12/23

Point-of-sale terminal maker PAX Technology Inc. released its Elys Workstation, a configurable POS device. It features a 14-inch screen, front-facing camera, and operates on the Android system. It can be paired with multiple PAX payment acceptance terminals. PayPal Holdings Inc.’s stock has traded in the mid-$60s range for days following a plunge early …

-

11 May

Payroc Acquires Atlantic Merchant; First American by Deluxe Adds SwipeSimple’s Software

Payroc WorldAccess LLC has acquired Atlantic Merchant Services, LLC for an undisclosed sum. Raleigh, N.C.-based-Atlantic Merchant serves merchants and businesses across the mid-Atlantic region, as well as West Virginia, Tennessee, Michigan, and Texas. Atlantic Merchant’s services include touchscreen POS, mobile solutions, e-commerce, countertop terminals, and smart-phone applications. Merchant segments serviced …

-

11 May

Mid-Market Specialists in Small And Medium Merchants Report Quarterly Gains

Mid-size payments processors have contended with a pandemic, a sharply rising cost of funds, and pronounced inflation over the past few years, but that hasn’t stopped them from capturing volume, particularly from the small and medium-size merchants that have long been their specialty. In results reported early Thursday, Alpharetta, Ga.-based …

-

11 May

Payment Card Shipments to Reach 471 Million And Other Digital Transactions News briefs from 5/11/23

ABI Research forecasted the number of physical, instantly issued payment cards globally will grow to 471.1 million shipments in 2027 from 243.2 million in 2022. Citicorp’s Citi Retail Services unit introduced its Citi Pay line of services, with the first product consisting of Citi Pay Credit, a digital credit card. An installment-loan product will …

-

10 May

Toast Launches Toast Tables; Tabit Partners With OpenTable

The major restaurant point-of-sale technology provider Toast Inc. early Wednesday reported revenues of $819 million for the first quarter of 2023, a 53% increase over the same period a year earlier. Recurring revenue for the quarter totaled $987 million, a 55% increase from a year earlier. In addition, Toast grew …