It’s a laurel, of sorts, that financial firms would like to rebuff. They sustained the largest share of phishing attacks in the fourth quarter, accounting for 27.7% of all attacks, followed by the broad “other” category at 18.2%, and webmail, software-as-a-service at 17.7%. That’s according to the Phishing Activity Trends …

May, 2023

-

10 May

Real-Time Payments Fraud on the Rise And Other Digital Transactions News briefs from 5/10/23

Real-time payment fraud is on the rise, even before the expected July launch of the Federal Reserve’s FedNow service. Some 71% of financial institutions reported an increase in consumer account takeover fraud using real-time payment networks from 2021 to 2022, according to a February and March survey of financial-institution executives internationally …

-

9 May

Real-Time Comes to Real Estate As EMTransfer And KeyBank Enable Payments Via TCH’s RTP Network

EMTransfer LLC, a real-estate cash-management platform provider, has teamed up with KeyBank to bring real-time payments to the real-estate industry through The Clearing House Payments Co.’s RTP network. Using application programming interfaces from KeyBank, EMTransfer can connect parties involved in the real-estate closing process, such as title insurance and escrow …

-

9 May

PayPal Makes Unbranded Checkout a ‘Strategic Imperative’ As Its CEO Prepares to Retire

PayPal has been known for some time as a major alternative for checkout online, but now the company is making it plain it’s putting considerable resources behind checkouts where its services function entirely in the background. So-called unbranded checkout, led by the company’s Braintree processing platform along with a relatively …

-

9 May

Payrange Acquires Vagabond And Other Digital Transactions News briefs from 5/9/23

Payrange Inc., a payments provider for the vending and unattended-retail market, announced it has acquired Vagabond, a cloud-based provider of business intelligence for the convenience-retail industry. Terms were not announced. Sales of contactless cards helped payment card manufacturer CPI Card Group Inc. increase overall first-quarter sales 8% year-over-year to $120.9 million, with sales …

-

8 May

Cantaloupe Launches Smart Technology for Grab And Go at Self-Service Environments

Cantaloupe Inc. is rolling out Cantaloupe Go, a line of self-service apps and kiosks that rely on artificial intelligence to enable consumers to purchase products in self-service retail locations, such as micro-markets. Cantaloupe Go comprises Cantaloupe’s line of self-checkout kiosks. which vary in cost, features, and payment-acceptance capabilities; Smart Store …

-

8 May

Merchants’ Cost Burden for Card Acceptance Has Long Been Flat, a Card Industry Group Argues

Merchants’ price for accepting credit cards has remained steady for years, according to data released Monday by the Electronic Payments Coalition, an advocacy group representing the payment card industry. The EPC’s release comes as widespread and longstanding merchant complaints about the cost of card acceptance have sparked efforts by federal …

-

8 May

Virsympay’s New Gateway And Other Digital Transactions News briefs from 5/8/23

Payments processor Virsympay, which serves small and medium-size businesses, launched a gateway that supports Google Pay and Apple Pay transactions along with conventional card and automated clearing house payments. Money transfer provider Paysend said Spanish-language content and media company TelevisaUnivision has become a shareholder in the company as part of a multiyear deal …

-

5 May

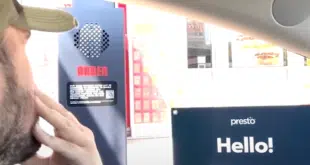

Presto Rolls Out Voice Ordering; SoundHound Integrates Voice Ordering With Oracle’s POS

Presto Automation Inc., a provider of artificial intelligence-based solutions for drive-through restaurants, is rolling out its voice-ordering system at participating Carl’s Jr. and Hardee’s drive-throughs nationwide. San Carlos, Calif.-based Presto had been piloting the technology at select Carl’s Jr. and Hardees locations. Carl’s Jr. and Hardees, which together have about …

-

5 May

GoDaddy Payment Volume Tops $1 Billion and other Digital Transactions News briefs from 5/5/23

GoDaddy Inc. reported payments volume from its various commerce services surpassed $1 billion annualized in the first quarter. The Web registrar has launched a number of payments initiatives in the past year, most recently a service that supports transactions through Microsoft Teams. Thinkific Labs Inc., a platform that supports creating, marketing, and …