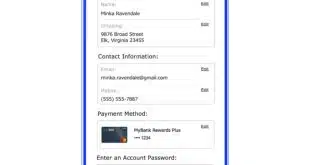

When it comes to online checkout, consumers like using digital wallets. Seventy-two percent of them value digital-payment tools like digital wallets to make the online checkout easier, says Paze in its inaugural Paze Pulse report. Paze is an upcoming digital wallet from Early Warning Services LLC. Backed by seven large …

February, 2024

-

21 February

AfterShip Apple Wallet Updates And Other Digital Transactions News briefs from 2/21/2024

AfterShip, an e-commerce service, said it has enabled merchant users to get real-time delivery updates and track orders through Apple Wallet. Fortress Payments, a fintech for credit card issuing and acquiring, said it will work with AI-software provider Paravision to update Fortress’s Payment Identity Platform via face-matching and “liveness” technology. …

-

20 February

Fiserv Extends Clover Discounts to Genesis Bank Merchants

Fiserv Inc. is partnering with Genesis Bank to provide low-to-moderate income small businesses in Southern California serviced by the bank access to its Clover point-of-sale technology at a reduced cost. The deal opens the door for low-to-moderate income small businesses a way to access to select Clover technology bundles with …

-

20 February

For Cap One, the Pulse Network Is the ‘Rare Asset’ in Its $35.3 Billion Deal for Discover

(Editor’s Note: This story follows up on news late Monday concerning a planned acquisition of Discover Financial Services by Capital One Financial Corp.) On the Tuesday morning after news broke that credit card giant Capital One Corp. intends to shell out $35.3 billion in an all-stock deal to acquire Discover …

-

20 February

Not Even 1% Want Crypto Checkout And Other Digital Transactions News briefs from 2/20/24

Cryptocurrency as a payment method is only wanted by less than 1% of online shoppers surveyed in a Chargebacks911 report. The survey was performed by consulting and research firm TSG of 4,000 consumers. Payments platform ConnexPay said it is working with the UATP network and has launched its ConnexPay UATP card, a virtual card that …

-

19 February

Capital One May Acquire Discover. What Could That Mean?

Capital One Financial Corp. may be on the brink of acquiring Discover Financial Services, if two news reports are accurate. The Wall Street Journal and Bloomberg.com separately reported on Monday a deal between the two credit card juggernauts is in the offing, with The Journal reporting an announcement could come …

-

19 February

The EU’s Fine Against Apple in Its Spotify Case Echoes a Familiar Story

The European Commission is planning to announce a fine of about 539 million euros ($500 million) on Apple Inc. next month after investigating a complaint from Sweden-based music app maker Spotify Technology SA regarding Apple’s policy of restricting apps from linking out to their own sites for services such as …

-

19 February

Lavu Hits the 1-Billion Transactions Mark Amid a Merchant Billboard Program

Restaurant point-of-sale specialist Lavu Inc. notes more than 1 billion orders have been placed on its POS platform. This comes as Lavu starts a restaurant advertising program featuring billboard advertising. Lavu, which debuted with an iOS app in 2010, now has customers in 65 countries. The billboard program, however, harkens …

-

19 February

Coinbase Tweaks Native Payments And Other Digital Transactions News briefs from 2/19/24

Coinbase Commerce said it will no longer support so-called native payments made with Bitcoin on its merchant platform but will support transactions in which the user has a Coinbase account. The move was made to avoid “challenging” processing issues Coinbase had encountered in handling Bitcoin transactions made by users without Coinbase …

-

16 February

NMI Launches an Embedded Payments Platform to Ease Integration And Processing for ISOs

Payments provider NMI LLC announced Thursday the launch of NMI Payments, a modular embedded-payments solution that enables software companies and independent sales organizations to integrate and accept payments online, in-store, in-app, through mobile devices, and at unattended payment terminals, according to the company. NMI Payments integrates within existing applications and …