The buy now, pay later trend emerged in the U.S. market in a big way in 2020 in the wake of the pandemic as a means to let strapped consumers make point-of-sale and online transactions with partial payments, while financing the balance over a short term. Since then, the U.S. …

February, 2024

-

12 February

Picklejar’s Contest Tools And Other Digital Transactions News briefs from 2/12/24

Picklejar Entertainment Group, whose software manages payments and other functions for events, launched contest-management capability incorporating the company’s identity-verification technology. Finmont, a travel-related payments-orchestration platform, has agreed to add processing from payments platform ConnexPay. William P. Foley II has been appointed chief executive of Cannae Holdings Inc., whose investments include a 6% …

-

9 February

COMMENTARY: Charting a Course Toward Transparent and Secure Digital Payments

Decentralized finance (DeFi) is revolutionizing the way consumers and businesses handle their financial affairs, offering an innovative alternative to traditional, centralized financial systems. This transformation is creating a dynamic financial landscape where both traditional finance methods and DeFi coexist, encouraging real-time, transparent, and secure digital payment solutions. This evolution presents …

-

9 February

How J.P. Morgan’s Ambitious Commerce Platform Enables Cross-Channel Payment Acceptance

J.P. Morgan Payments sees the future of electronic commerce as one pipeline accessed by consumers across channels. Its role in that scenario is outlined by the debut earlier this year of what it calls a full-stack omnichannel service, one that offers in-store, online, and mobile checkout capabilities. “We realized merchants …

-

9 February

Cantaloupe Revenue up 7% and other Digital Transactions News briefs from 2/9/24

Cantaloupe Inc., a payments processor for vending machines and unattended markets, reported 1.23 million active devices online at the end of its December quarter, up 7% year-over-year. Active clients totaled 30,027, a 14% rise. Revenue for the quarter came to $65.4 million, up 7%, while transaction volume grew 12% to …

-

8 February

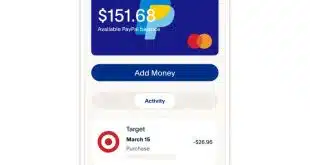

PayPal’s New CEO Begins Acting on His Promise to Shake up the Payments Giant

When Alex Chriss came from Intuit last fall to take over as chief executive of PayPal Holdings Inc., he made it plain there would be big changes in strategy coming soon. On Wednesday, he began delivering on that promise, asserting the payments company is going to promote so-called branded checkout …

-

8 February

ABA Formalizes BIN Administration Handoff to Long-Term Partner CUSIP

CUSIP Global Services announced late Wednesday that it will be taking over day-to-day operations of the administration of the issuer identification number system from the American Bankers Association. The change is not monumental as CUSIP has a long history of managing numbering programs for the financial services industry. The ABA …

-

8 February

Lightspeed Loss Narrows And Other Digital Transactions News briefs from 2/8/24

Payments provider Lightspeed Commerce Inc. reported December-quarter revenue of $239.7 million, up 27% year-over-year. The company narrowed its net loss to $40.2 million from $814.8 million a year ago. Payments platform FleetCor Technologies Inc. reported December-quarter revenue of $937.3 million, up 6% year-over-year. Net income rose 6% to $255.9 million. For full-year 2023, revenue …

-

7 February

Payroc Beefs Up Its Presence in Canada With Its Deal for SterlingCard

Payments-platform provider Payroc LLC has expanded its footprint in Canada through its acquisition of SterlingCard Payment Solutions Inc., a provider of retail and e-commerce payment solutions, for an undisclosed sum. Tinley Park, Ill.-based Payroc announced mid-day Tuesday it had closed on the deal. The acquisition enables Payroc to offer a …

-

7 February

PSCU/Co-op Debuts a BNPL Service for Credit Unions

Credit union service organization PSCU/Co-op Solutions released its buy now, pay later service to credit unions, enabling their cardholders to make installment payments on their card-based purchases. PSCU/Co-op, which merged Jan. 1, says cardholders whose credit unions enroll in the service can choose qualifying transactions to pay back in installments. …