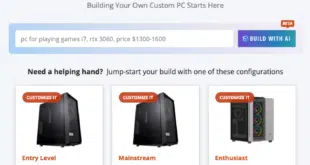

What’s the future of shopping going to be like? If consumers have their way, it will be more personalized and convenient, found the “Future of Shopping” report from Synchrony. And online retailer Newegg Commerce Inc. is incorporating artificial intelligence tool ChatGPT into its shopping protocols. With increased sophistication in personalization, …

March, 2023

-

27 March

First Citizens Buys SVB And Other Digital Transactions News briefs from 3/27/23

First Citizens Bank & Trust Co. reached an agreement with the Federal Deposit Insurance Corp. to buy Silicon Valley Bridge Bank after a competitive bidding process. Terms include FCB’s assumption of $110 billion in assets, $56 billion in deposits, and $72 billion in loans. Starting Monday, the 17 SVB branches will operate as …

-

24 March

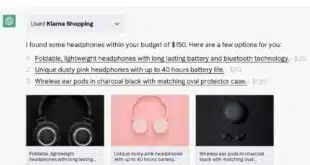

Klarna Adds ChatGPT as an Enhancement to Online Shopping

ChatGPT, the artificial intelligence-based chatbot developed by OpenAI, is being rolled out by Klarna AB to provide what the payments platform calls personalized and intuitive shopping experiences. Online shoppers will be able to ask Klarna, through the chatbot, for product recommendations, as well as receive links to shop recommended products …

-

24 March

Conflicting Appeals Court Decisions Add Nuance to a CFPB Supreme Court Case

With a federal appeals court ruling on Thursday upholding the Consumer Financial Protection Bureau’s constitutionality, the CFPB, along with its severest critics, find themselves at a crossroads at a time when the agency has become significantly more energetic in overseeing the payments industry. The latest ruling, from the Federal Court …

-

24 March

PayPal’s Passkey Makes Android Debut And Other Digital Transactions News briefs from 3/24/23

Buy now, pay later provider Affirm Inc. announced its users can deploy the service at VersaClimber, a vendor of exercise machines. Cybersecurity firm McAfee Corp. will offer savings on online protection via a new agreement with Mastercard Inc.’s Easy Savings program, a service through which business cardholders receive rebates on common business expenses. Strike, …

-

23 March

A2A Payments A Growing Force In Payments

Account-to-account payments is becoming a growing force in the payments landscape, totaling $525 billion in global e-commerce transaction value in 2022, up from $463 billion in 2021, a 13% increase, according to the FIS Global Payments Report 2023. The volume was funneled through about 70 real-time payment schemes providing high-speed …

-

23 March

COMMENTARY: Gun Sales Can Be Tracked, But MCC Codes Are the Wrong Tool for the Job

Plenty of attention has been given recently to the tracking of gun sales, with no lack of argument for and against. This article lies outside of any market motives or political opinions. It speaks only to the underlying mechanism of tracking purchases. As an engineer and a pragmatist, I can …

-

23 March

The FTC’s ‘Click to Cancel’ Button And Other Digital Transactions News briefs from 3/23/23

The Federal Trade Commission issued a proposed rule that would require sellers to offer a “click to cancel” button that customers could use to more easily stop subscriptions and recurring payments. A global survey on cross-border payments found 29% of mid-size and large U.S. businesses cite high transaction cost as a challenge, …

-

22 March

Panera Bread Rolls Out the Amazon One Biometric Tech in Select Locations

Panera Bread on Wednesday announced it is adopting Amazon One, Amazon.com Inc.’s biometric-payment technology, at select locations in the St. Louis area. The deployment of Amazon One, which links a customer’s payment card to his or her palm print, is expected to make it easier for Panera customers to access …

-

22 March

Familiar Names Grace the Upper Reaches of the Latest Strawhecker Merchant Acquirer Directory

No surprise, the top merchant acquirer by payment volume remains JPMorgan Chase & Co., according to the 2023 edition of Directory of U.S. Merchant Acquirers from TSG, formerly known as The Strawhecker Group. With volume of $2.15 trillion, Chase retained the top spot last year that it has held since …