The regulated online sports-betting and casino market in the United States has exploded in recent years following the Supreme Court’s repeal of the Professional and Amateur Sports Protection Act (PASPA) back in 2018. This repeal put the power to regulate single-event sports betting in state hands, with many subsequently passing …

August, 2022

-

19 August

Blackhawk Network’s Get Sports-Betting Gift Card OK and other Digital Transactions News briefs from 8/19/22

Blackhawk Network has received approval to offer its sports-betting gift card line, including its 2-year-old Game On card, in New York and Louisiana.Community Brands, a software and payments platform for nonprofits and schools, announced it has acquired BigSIS, a vendor of management software for educational institutions. Terms were not disclosed.Payments-technology provider Quisitive …

-

18 August

BNPL Is Eating Into Credit Card Usage, J.D. Power Finds

Consumers are spending significantly less on their primary credit cards, says J.D. Power’s 2022 U.S. Credit Card Satisfaction Study. Overall, credit card holders are allotting 42% of their monthly spending to their primary credit cards, down from 47% in 2021 and 2020, and down from 50% from 2019. That decline …

-

18 August

Adyen Embraces POS Hardware with New Devices and a Development Focus

Adyen Inc., a long-time online payments provider, is further boosting its in-store payment acceptance options with the addition of two new point-of-sale devices. Both were designed by Adyen. Dubbed the NYC1 and AMS1 devices, they complement a suite of other POS terminals launched in January. The NYC1 device is designed …

-

18 August

RMS Acquires OrbaGraph And Other Digital Transactions News briefs from 8/18/22

OrbaGraph, a payment automation firm, said Revenue Management Solutions acquired the company. Private equity firm Thompson Street Capital Partners funded the acquisition. Terms were not disclosed.Dan Price, cofounder of Gravity Payments, which set a minimum starting annual salary of $70,000 for his employees and cut his salary from $1 million …

-

17 August

Fed Accounts Are Now Open to Fintechs With a Bank Charter Under New Guidelines

For years, payments fintechs with a bank charter have labored under a requirement that, for money movement, deposit-taking, and other related services, they largely had to work with another federally chartered bank. This week, the nation’s top banking regulator announced an important change to its rules that could sweep away …

-

17 August

Sezzle And Klaviyo Team Up To Make BNPL a Tool To Reduce Shopping Cart Abandonment

To help e-commerce merchants reduce shopping cart abandonment, Sezzle Inc. is partnering with customer platform provider Klaviyo. The deal will allow Klaviyo merchants to offer online shoppers a buy now, pay later loan when they abandon their shopping cart. Shopping cart abandonments are a nettlesome problem for e-commerce merchants, with …

-

17 August

Tulip Completes Moneris Integration And Other Digital Transactions News briefs from 8/17/22

Tulip.io Inc., a Toronto-based point-of-sale system provider, said it has a certified integration with Moneris Solutions Corp., a large payment processor in Canada. Moneris had a U.S. presence prior to 2016 when it sold the U.S. business to Vantiv Inc.The Western Union Co. said it has renewed an agreement to support digital …

-

16 August

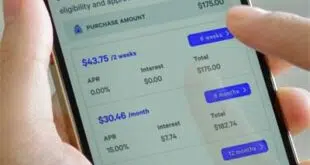

Eye on BNPL: BigCommerce Goes Big With Affirm; Telispire Dials up Splitit’s BNPL Option

E-commerce platform BigCommerce Pty. Ltd. is expanding its deal with installment-payment provider Affirm Inc. to now include merchants of all sizes. Additionally, the broadened deal affords merchants the ability to offer custom payment options, such as bi-weekly and monthly options for eligible customers on purchases ranging from $50 to $17,500. …

-

16 August

Average ATM Withdrawals Are Bigger, But Transactions Still Lag Pre-Pandemic Levels

ATM traffic worldwide is on the rebound after two years of pandemic, but it will take years for cash withdrawal transactions to return to 2019 levels, according to “Global ATM Markets and Forecasts to 2027,” a report released this week by RBR, a London-based research firm. ATM activity declined in …