Digital-currency payments specialist Circle Internet Financial LLC announced it has agreed to new terms with Concord Acquisition Corp., terminating an agreement it had reached with that company in July. The new agreement values Circle at $9 billion, twice the valuation set by the original SPAC combination. The holding company established by the original agreement …

February, 2022

-

16 February

Shift4 Snags D.C.’s Audi Field As Its Latest Sports-Venue Client for Mobile Transactions

As sports fans return to stadiums after nearly two years of the Covid pandemic, payment processors are eyeing a big opportunity for transaction volume. In the latest development, one of the biggest players in this game, Shift4 Payments Inc., said early Wednesday it has signed Audi Field in Washington, D.C., …

-

16 February

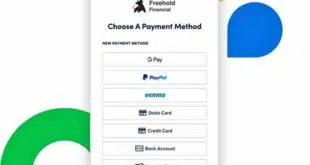

As Users Seek More Choices, PayNearMe Adds PayPal And Venmo To Its Bill Pay Platform

Responding to demand from consumers and billers for digital bill-payment options, electronic billing and payment platform provider PayNearMe Inc. on Tuesday announced the addition of PayPal and Venmo to its payment options. A recent study by PayNearMe revealed that 43% of respondents rated the convenience of using PayPal to pay …

-

16 February

BIM Launches BuyPass ACH Service and other Digital Transactions News briefs from 2/16/22

Payments-technology firm Buy It Mobility launched BuyPass, a platform aimed at allowing merchants to more quickly launch automated clearing house and merchant-branded payments programs. BIM is working with network capabilities and virtual card technology from Discover Network to reduce the time and cost for merchant integration.Transaction-security firm Forter launched Smart Payments, a technology that uses the …

-

15 February

MoneyGram Will Go Private in $1.8 Billion Deal With Private-Equity Player Madison Dearborn

Money-transfer powerhouse MoneyGram International Inc. will go private later this year in a deal announced Tuesday with private-equity firm Madison Dearborn Partners LLC. Valued at $11 per common-stock share, the deal also includes assumption of $799 million in debt. Expected to close in the fourth quarter, the deal will see …

-

15 February

FIS’s Top Brass Looks for Big Results Among Small Sellers Following the Payrix Deal

FIS Inc.’s acquisition of Payrix Solutions LLC, announced Monday, comes as e-commerce is booming and as payments platforms are weaving payments capabilities into the software they’re selling to online merchants. The deal will also help FIS, known for its processing capabilities for enterprises, reach small and medium-size online sellers, top …

-

15 February

ACI PayAfter BNPL Service Debuts and other Digital Transactions News briefs from 2/15/22

ACI Worldwide Inc. announced ACI PayAfter, a buy now, pay later service that provides merchants access to more than 70 BNPL providers via a single integration. “ACI PayAfter gives consumers one BNPL option—ACI PayAfter—displayed at checkout, one application form, and a single credit check, all while providing access to multiple financing …

-

14 February

Epos Now’s New App Links U.S. Third-Party Delivery Platforms With Restaurants

With online ordering capabilities now table stakes for restaurants, Epos Now, a London-based provider of cloud-based software, announced Monday it is rolling out its Epos Now Delivery application for restaurants in the United States. The decision to launch Epos Now Delivery in the U.S. market was prompted by the massive …

-

14 February

Paysafe Extends Its Reach in U.S. Sports Betting With Deals in Louisiana And Oregon

The major United Kingdom-based payments processor Paysafe Ltd. has extended its reach in the U.S. sports-betting market, announcing early Monday deals to support bettors’ deposits by credit or debit card in Louisiana and Oregon. Driving Paysafe’s latest gambit in mobile sports betting includes contracts with venue-operator Caesars Entertainment Inc. and betting …

-

14 February

F1 Payments Adopts Corvia Moniker and other Digital Transactions News briefs from 2/14/22

Four-year-old payments provider F1 Payments announced it has changed its name to Corvia, effective immediately.Electronic funds transfer network Shazam announced it is offering DocuCommand, a document-management service, to client banks and credit unions.Mastercard Inc. said it expanded its partnership with Fearless Fund, a venture capital fund created by women of color for women of …