Payments provider Veem Inc. launched several new products for small businesses, including Veem Invoicing and Veem Collections.Cryptocurrency platform OKCoin USA Inc. has chosen FIS’s Worldpay unit to provide merchant acquiring and global exchange service in support of OKCoin’s ongoing global expansion.Visa Inc. said it will launch later this year an “evolved” brand identity featuring refreshed …

July, 2021

-

20 July

Mastercard Outlines a Pilot for Direct Acceptance of Cryptocurrency Via Stablecoins

Card-based cryptocurrency transactions at the point of sale require conversion of the crypto assets to fiat currency for acceptance by the card networks. Now, the two top card networks are starting to change that. Mastercard Inc. early Tuesday said it will work with a pair of issuing banks and several …

-

20 July

Sezzle Capital Debuts and other Digital Transactions New briefs from 7/20/21

Buy now, pay later provider Sezzle Inc. launched Sezzle Capital, a program that provides working capital up to $10 million to qualified merchants. The service is built on the Wayflyer funding platform.Square Inc. launched Square Banking, based on the company’s industrial bank, Square Financial Services, which began operating in March. The banking offering consists …

-

20 July

Payveris Looks To Take On P2P Heavyweights With A Real-time P2P Payment Option

The hotly competitive peer-to-peer payments market got even more crowded Tuesday with the entry of Payveris LLC, a digital money-movement platform provider. The new service, which Cromwell, Conn.-based Payveris expects will compete with the P2P stalwarts Zelle, Venmo, and Cash App, will enable real-time P2P payments over the debit card …

-

20 July

The Path to Painless Integrated Payments

By Sherrie Bryant, Marketing Director, Exact Payments Payments integration is quicker and easier when the gateway provides developers with REST APIs and the tools and support necessary for successful projects. As more merchants evolve into omnichannel businesses, integration equals efficiency. Integrated solutions communicate with each other and share data, helping …

-

19 July

Infinicept Launches a Network to Help Link Software Firms With Payments Resources

For years, one of the fastest-growing trends in payments has been the idea of weaving transactional capability into business and consumer software. Now, one of the most prominent platforms in that business has launched a network to help connect software firms with payments companies and resources. “We’re doubling down on …

-

19 July

Bill.com Acquires Invoice2go and other Digital Transactions News briefs from 7/19/21

Business payments provider Bill.com announced the $625 million acquisition of Invoice2go, a mobile-first accounts receivable software provider. The stock and cash transaction is expected by the end of 2021.U.S. blockchain-payments specialist GreenBox POS LLC has agreed to acquire Europe-based processor Transact Europe Holdings OOD for 30 million euros, or approximately $35 million. The deal …

-

19 July

COMMENTARY: B2B Payments are Broken. Here’s What the Industry Can Learn from Consumers

The consumer-payments industry is thriving. Last year, consumers embraced more payment methods than ever, a behavior that companies like Stripe (now valued at $95 billion ahead of a highly anticipated Wall Street debut) are banking on in a post-Covid world. In fact, a recent Deloitte report tells us that, in …

-

16 July

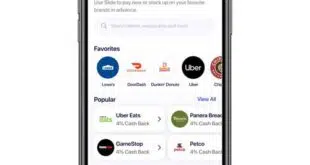

Slide Mobile Adds In-App Shopping for Online Purchases

Responding to consumer demand for an easier way to shop and earn rewards online, Raise Marketplace LLC announced Thursday the launch of an in-app shopping feature for its Slide mobile app. Consumers can now connect directly through the Slide app to the company’s more than 200 merchant partners to shop, …

-

16 July

Discover Is the Latest Card Network to Bust Into BNPL, a Market With Heated Rivalry

The buy now, pay later trend has gained enough steam that the major card networks can’t afford to ignore it. The latest evidence that the credit card giants want to hedge their bets came this week with the news that Discover Financial Services invested $30 million in Minneapolis-based Sezzle Inc., …