As part of its ongoing efforts to make purchasing cryptocurrency easier and attract new users, Atlanta-based blockchain-payment processor BitPay Inc. is teaming with Simplex Payment Services, a Vilnius, Lithuania-based financial institution, to enable European consumers to purchase cryptocurrency using a credit or debit card and incur no cardholder fees for 45 …

February, 2021

-

15 February

Eye on POS: EVO Debuts SimpleTab for Hospitality And GiftLogic Pairs up With Paystri

EVO Payments Inc. says its new SimpleTab point-of-sale feature can reduce table-turnover time for hospitality merchants. Meanwhile GiftLogic says it has integrated Paystri, a payments-technology company, into its POS software. The SimpleTab payment feature from Atlanta-based EVO works with the Ingenico Move/5000 payment terminal and supports EMV, contactless, and swipe card …

-

15 February

Boyd Gaming Debuts Wallet and other Digital Transactions News briefs from 2/15/21

Gaming-properties operator Boyd Gaming Corp. launched a digital wallet, working with gaming-technology provider Aristocrat Technologies and payments provider Sightline Payments. The service, called BoydPay, is live at Blue Chip Casino Resort Spa, Belterra Park, and Aliante Casino.Payments provider National Merchants Association launched a program that offers free credit card processing for three months and …

-

12 February

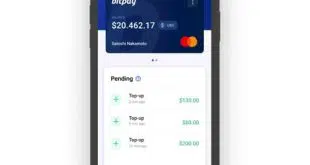

BitPay Moves to Boost Cryptocurrency’s Acceptance by Striking a Deal with Apple Pay

The push to increase the utility of cryptocurrency for purchases got a shot in the arm Friday as BitPay Inc., an Atlanta-based processor that offers crypto e-wallets, announced its prepaid Mastercard cardholders can add their card to the Apple Wallet and make purchases using Apple Pay. The BitPay Mastercard is …

-

12 February

Cryptocurrency Begins Its Move Up From the Minor Leagues for Mastercard And Visa

The two big card networks have made no bones about their interest in supporting cryptocurrency transactions, and this week both made big moves in that direction. The bigger move came from Mastercard Inc., which on Wednesday announced its intention to launch later this year the ability to send and receive …

-

12 February

BNPL Specialist Affirm Adds 52% More Customers and other Digital Transactions News briefs from 2/12/21

Affirm Inc. said it had 4.5 million active customers in its fiscal 2021 second quarter ended Dec. 31, a 52% increase from the second quarter of fiscal 2020.Payments provider Repay Holdings Corp. said an integration with PN3 Solutions, a software provider for business-to-business payment automation, will allow PN3’s clients to complete payments to …

-

11 February

Mogo Buys A Piece of Cryptocurrency Trading Platform Coinsquare

Payments-technology provider Mogo Inc. is initially acquiring about 20% of Coinsquare, a Canadian cryptocurrency-trading platform, for US$44.4 million, with an option to purchase another 20% in the future. Mogo’s first option to increase its investment in Coinsquare, which acts as the trading platform for MogoCrypto, which Mogo launched in 2018, …

-

11 February

Despite a Tough Year, Digital Transfers Shone Brightly for Western Union

Hampered early on by Covid-19, The Western Union Co. late Wednesday said its growing digital-transfer business helped buoy its results for the fourth quarter and the full year. Overall, revenue from digital transfers, including activity on Westernunion.com, grew 36% in the fourth quarter year-over-year and accounted for just over one-fifth …

-

11 February

Uplift Signs Travel BNPL Clients and other Digital Transactions News briefs from 2/11/21

Buy now, pay later specialist Uplift Inc. said it signed new travel brands and experienced a 72% growth in monthly transaction revenue in the 2020 fourth quarter. New clients coming online in the second quarter include Alaska Airlines, Frontier Airlines, Virgin Voyages, and Air Canada Vacations.ACI Worldwide Inc. said it and Gilbarco Veeder-Root, …

-

10 February

How OLB Group Hopes to Win Over Merchants for Cryptocurrency Acceptance

Betting that consumer demand to use cryptocurrency as a payment vehicle will rise over the long term, payments provider The OLB Group Inc. announced Wednesday that its SecurePay payment gateway will support the acceptance of Bitcoin and other digital currencies at the point of sale regardless of the merchant platform. …