While many payments companies have had their hands full contending with the many impacts of the Covid-19 pandemic, payments firms with e-commerce platforms have thrived as consumers flocked to online buying. Shopify Inc. demonstrated Wednesday just how much it’s investing in shopping and payments apps to capitalize on the growth …

February, 2021

-

17 February

Klarna’s Crypto Foray and other Digital Transactions News briefs from 2/17/21

Payments provider Klarna AB has entered the cryptocurrency market with an agreement with Swedish crypto broker Safello, which is launching Klarna Open Banking to allow 180,000 Safello users to buy digital currencies directly from their bank accounts.Mastercard Inc. and payments provider Island Pay have collaborated with the central bank of the Bahamas to …

-

16 February

Debit Card Use on Amazon Soars 70%, PSCU Report Finds

With little indication e-commerce spending is slowing, consumers are favoring using their debit cards on Amazon.com Inc., with a 70% increase in debit card transactions at the giant e-commerce retailer for the week ending Feb. 7, compared to the week ending Feb. 9, 2020. That’s according to the latest Tracking …

-

16 February

PayPal Opens Its New Venmo Credit Card to Users Generally

PayPal Holdings Inc. on Tuesday threw the door wide open for applications for its new Venmo credit card. The Visa-branded card, which the company has had in the works since 2019 and began issuing to select users in October, includes a Quick Response code, a rewards structure, and, through the Venmo …

-

16 February

AeroPay Enters Online Cannabis Payments with Olla and other Digital Transactions News briefs from 2/16/21

AeroPay, a fintech that provides payment processing service to cannabis businesses, said it and Olla, an e-commerce platform for cannabis retailers, will offer online payments. AeroPay will be integrated as a cashless payment method to consumers ordering online through white-labeled e-commerce sites provided by Olla. Payments are made via bank-to-bank …

-

15 February

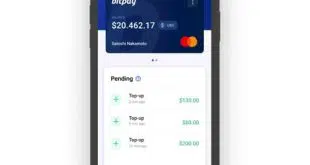

Crypto on a Credit Card? BitPay Says Its Simplex Deal Makes it Easier And Cheaper

As part of its ongoing efforts to make purchasing cryptocurrency easier and attract new users, Atlanta-based blockchain-payment processor BitPay Inc. is teaming with Simplex Payment Services, a Vilnius, Lithuania-based financial institution, to enable European consumers to purchase cryptocurrency using a credit or debit card and incur no cardholder fees for 45 …

-

15 February

Eye on POS: EVO Debuts SimpleTab for Hospitality And GiftLogic Pairs up With Paystri

EVO Payments Inc. says its new SimpleTab point-of-sale feature can reduce table-turnover time for hospitality merchants. Meanwhile GiftLogic says it has integrated Paystri, a payments-technology company, into its POS software. The SimpleTab payment feature from Atlanta-based EVO works with the Ingenico Move/5000 payment terminal and supports EMV, contactless, and swipe card …

-

15 February

Boyd Gaming Debuts Wallet and other Digital Transactions News briefs from 2/15/21

Gaming-properties operator Boyd Gaming Corp. launched a digital wallet, working with gaming-technology provider Aristocrat Technologies and payments provider Sightline Payments. The service, called BoydPay, is live at Blue Chip Casino Resort Spa, Belterra Park, and Aliante Casino.Payments provider National Merchants Association launched a program that offers free credit card processing for three months and …

-

12 February

BitPay Moves to Boost Cryptocurrency’s Acceptance by Striking a Deal with Apple Pay

The push to increase the utility of cryptocurrency for purchases got a shot in the arm Friday as BitPay Inc., an Atlanta-based processor that offers crypto e-wallets, announced its prepaid Mastercard cardholders can add their card to the Apple Wallet and make purchases using Apple Pay. The BitPay Mastercard is …

-

12 February

Cryptocurrency Begins Its Move Up From the Minor Leagues for Mastercard And Visa

The two big card networks have made no bones about their interest in supporting cryptocurrency transactions, and this week both made big moves in that direction. The bigger move came from Mastercard Inc., which on Wednesday announced its intention to launch later this year the ability to send and receive …