Investors in payment stocks experienced something in September they don’t have to suffer through very often—two straight months of negative returns. A basket of 27 transaction-processor stocks tracked by Chicago-based Barrington Research Associates Inc. posted a negative mean return of 3.89% in September, considerably worse than three major stock-market indexes. …

October, 2019

-

2 October

A Top Libra Executive Rebuts a Report That Backers’ Support Is Wavering

A report Wednesday that at least some members of the consortium backing Facebook Inc.’s Libra cryptocurrency project—including Visa Inc. and Mastercard Inc.—are having second thoughts has drawn fire from the top Facebook executive in charge of the project. “The tone of some of this reporting suggests angst, etc….I can tell …

-

2 October

Jury Awards $135 Million to ISO in Breach-of-Contract Lawsuit Against Global Payments

Global Payments Inc. may be on the hook for more than $135 million following a jury verdict in a breach-of-contract lawsuit filed by an independent sales organization against the Atlanta-based processor. A jury in the Superior Court of DeKalb County in Georgia found that Global Payments breached parts of its …

-

2 October

Drury Revises Breach Dates and other Digital Transactions News briefs from 10/2/19

Drury Hotels Co., which in May disclosed a data breach involving reservations made through some third-party online booking sites, now says the breach involved transactions from Dec. 28, 2017, to June 2 of this year, about two-and-a-half months longer than the originally stated timeline. Drury said “unauthorized access” occurred on …

-

1 October

UnionPay International Claims 28 Million Merchants and 120 Million Cards

The Shanghai-based UnionPay International payment network reported Monday that it now has 28 million accepting merchants outside of China and 120 million cards issued by non-mainland financial institutions since it launched its global business in 2004. But while UnionPay International now has a presence in 176 countries, with Chile and …

-

1 October

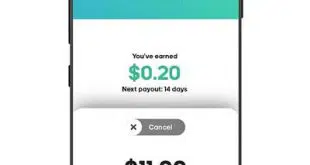

Mobile Payments Firm AeroPay Launches a Cash-Back Incentive

AeroPay, the mobile-payments service from Aero Payments LLC, debuted a 1% cash-back rewards program for its users. AeroPay, which uses a connection to the automated clearing house network for its transactions via Dwolla Inc., says consumers using its iOS or Android app can earn unlimited 1% cash-back rewards. The payout …

-

1 October

Pricing Is Top FedNow Inquiry and other Digital Transactions News briefs from 10/1/19

The Federal Reserve, which is taking industry comments on its upcoming FedNow real-time payments network until Nov. 7, said common questions so far involve pricing and the scope of the service. The first question can’t be answered yet, and the second touches on services that will be designed by financial institutions building on top …

September, 2019

-

30 September

As Real-Time Payments Rivalry Heats up, Vendors Eye Market Niches And Mid-Tier Institutions

With The Clearing House Payments Co. operating a real-time payments network and the Federal Reserve planning one for no later than 2024, payments companies are looking at slices of the market for opportunities in instant money movement. And these niche plays aren’t just the province of the country’s biggest banks. …

-

30 September

New York Sues Dunkin’ Over Breach and other Digital Transactions News Briefs from 9/30/19

The New York attorney general is suing Dunkin’ Brands Group Inc. for allegedly violating the state’s data-breach notification act by failing to notify nearly 20,000 customers that their Dunkin’ accounts had been compromised in a series of brute force cyberattacks beginning in 2015. Hackers also gained unauthorized access to more than 300,000 accounts in …

-

30 September

COMMENTARY: Here’s Why the Fed Should Stay Out of Real-Time Payments (Part II)

Tech behemoths Google, Amazon, and Apple, goliath retailers Walmart and Target, and PayPal, all support the Federal Reserve providing faster payments via its FedNow service, slated for introduction by 2024. Each of them, however, would howl in protest if Washington proposed competing with their business or helping would-be competitors. Fearing The Clearing …