Community banks, known for their personal touch and deep community ties, face unique challenges and opportunities to deepen those relationships. Introducing commercial credit cards is a strategic decision that aligns well with their commitment to local businesses. Offering a best-in-class commercial card program meets the needs of local enterprises and …

June, 2024

-

14 June

Shift4 Closes Revel Deal and other Digital Transactions News briefs from 6/14/24

Shift4 Payments Inc. announced it has acquired a majority interest in Germany-based point-of-sale provider Vectron Systems AG in a transaction previously reported by Digital Transactions News. Vectron serves roughly 65,000 merchant locations throughout Europe. Shift4 also said it has closed on its previously announced deal for Revel Systems, a point-of-sale technology company serving more than …

-

13 June

CardFree Enlists AI To Get Consumers To Spend More

Everyone has encountered the upsell. It’s the extended-warranty offer when buying a TV, or the ask to add a Danish to the coffee you just purchased. Now, CardFree Inc. has released a tool to help merchants automate the upsell with its new Smart AI Upsell feature. A component of CardFree’s …

-

13 June

Looking to Snag Millennials and Gen Zers, eBay Adds Venmo

EBay Inc. is recruiting Venmo as a payment option, the big e-commerce marketplace announced early Thursday. The move, which comes about a week after eBay announced it will no longer accept American Express cards effective Aug. 17, is part of a strategy to add alternative payment options that appeal to …

-

13 June

Visa Relaunches Savings Edge and other Digital Transactions News briefs from 6/13/24

Visa Inc. has re-launched Savings Edge, a rewards and discount program for U.S. and Canadian businesses that use Visa Business credit, debit, and reloadable prepaid cards. The re-launch includes revamped offers and a refreshed Web site, Visa says. In related news, Visa announced “Prodigies,” a promotional film aimed at reinforcing the …

-

12 June

Men Are Now the Primary Buyers of Gift Cards, Blackhawk Network Finds

Men have supplanted women as the primary buyers of gift cards, says a report from Blackhawk Network. The shift is attributable to men taking on more household responsibilities, such as shopping and gifting, the report says. Blackhawk has been conducting the survey for nearly a decade. Types of gift cards …

-

12 June

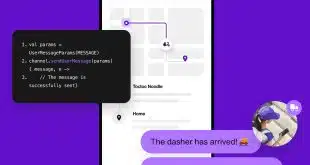

Shopify Makes Sendbird’s AI Chatbot Available in Its App Store

Shopify Inc. merchants looking for a way to add a chatbot with artificial-intelligence capabilities to their Web sites have a new option with the Sendbird Inc. chatbot. San Mateo, Calif.-based Sendbird’s chatbot is used by 4,000 apps, including DoorDash, Noom, and Yahoo Sports. Ottawa, Ontario-based Shopify says the Sendbird AI …

-

12 June

Dash’s Visa Real-Time Deal and other Digital Transactions News briefs from 6/12/24

Payments platform Dash Solutions has expanded an agreement with Visa Inc. to include a capability for Dash users to send real-time payments to cards, bank accounts, and mobile wallets using Visa Direct, Visa’s faster-payments platform. The payments fintech Bread Financial said its Comenity Capital Bank will issue Saks Fifth Avenue’s World Elite Mastercard and …

-

11 June

Payment Choice Is A Key Driver In The Customer Experience, Fiserv Finds

Providing consumers more ways to pay and engage with merchants play key roles in driving consumer purchasing decisions, according to Fiserv Inc.’s Spring 2024 Carat Insights Report. One way for merchants to engage on a deeper level with consumers is to offer apps featuring loyalty and rewards programs and that …

-

11 June

Affirm’s BNPL And Tap to Cash Are Coming to Apple Pay Later This Year

Apple Inc. says iPhone users will be able to send funds to each other by simply holding their iPhones next to each other. It’s a further refinement of Apple’s financial services, which jumped off in 2014 with the launch of Apple Pay. In a video presentation Monday, Apple executives say …