Small businesses experienced a single boost in April from March, according to the Fiserv Small Business Index. The metric increased from 150 in March to 151 in April, Fiserv Inc. says, reflecting activity from small businesses providing more essential services. Consumers, however, have pulled back on their discretionary spending. “Small …

May, 2025

-

5 May

ServiceMonster Payments Debuts and other Digital Transactions News briefs from 5/5/25

ServiceMonster, whose software serves carpet- and window-cleaning providers, launched ServiceMonster Payments, a platform allowing service providers to process payments within the ServiceMonster desktop or mobile app. Payment finance platform Infini has launched its Global Card, a virtual card that offers yields on stablecoin balances and spending through such wallets as Apple Pay, …

-

2 May

Canadians prioritize security above all when evaluating new payment technologies

Jon Purther, Director of Research at Payments Canada The payment landscape is rapidly changing, and new technologies like generative artificial intelligence (GenAI), social commerce and pay-by-bank are poised to dramatically transform the way we shop and pay. A recent study from Payments Canada shows that Canadians are hesitant to embrace these …

-

2 May

Despite Lower-Than-Expected Profit And Cash App Softness, Block Remains Bullish

Block Inc. remains bullish that its Cash App financial-services platform will remain a growth driver this year, despite its posting lower than projected gross profits during the first quarter, the company said during a conference call late Thursday to discuss its first-quarter results. Block is the parent company of the …

-

2 May

Crypto Operators Keep Chipping Away at a Merchant Acceptance Barrier

Cryptocurrency remains far from mainstream payments, but it keeps edging closer in the United States and worldwide. Further evidence emerged early Friday with news that the money-transfer platform MoneyGram International Inc. has launched MoneyGram Ramps, an application programming interface aimed at easing crypto-based transfers. Simultaneously, a crypto app called Bitget …

-

2 May

Priority Sports Goes Wild and other Digital Transactions News briefs from 5/2/25

Priority Sports, a unit of the payments provider Priority Technology Holdings Inc., announced it has processed ticket sales since March for the Minnesota Wild, a National Hockey League team. A survey from Jack Henry & Associates Inc. found that 89% of financial institutions plan to add new payment services, including the FedNow real-time payments …

-

1 May

Payments as a growth strategy – how ISVs can optimize revenue potential with embedded finance

Steven Velasquez, Senior Vice President and Head of Partner Business Development – U.S. Bank | Elavon As the worlds of technology and financial services converge, the pace of innovation is increasing exponentially. The advent of AI, cloud-based, headless architecture, and ‘everything-as-a-service’ presents a challenge to ISVs looking to adapt to …

-

1 May

AI Commerce Gets a Boost From Visa, PayPal, and Mastercard

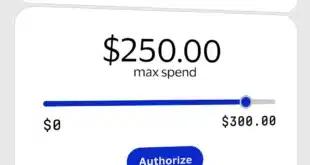

Visa Inc. late Wednesday introduced Visa Intelligent Commerce, an artificial intelligence-based shopping service that enables AI agents to shop and make purchases for consumers. AI agents are software programs that use artificial intelligence to gather information and take actions to achieve clearly defined goals with a minimum of human intervention. The …

-

1 May

Mastercard Reckons With a Cap One Impact As Its Crypto Investment Grows

The payments industry may soon be wrestling with the fallout from the upcoming $35-billion merger of Capital One Financial Corp. and Discover Financial Services, and one key question emerging from the deal is how it will affect Mastercard, the network for Cap One’s credit and debit cards. Early on Thursday, …

-

1 May

EMS’s Latest Moves and other Digital Transactions News briefs from 5/1/25

Electronic Merchant Systems, also known as EMS, said it has invested in Payment Nerds and Pet Payments, both of which have signed distribution agreements with EMS. The extent of the investment was not disclosed. Merchant services and check printer Deluxe Corp. reported $536.5 million in first quarter 20245 revenue, up 0.3% from …