Artificial intelligence tools may still be in development, but their utility for acquirers is quickly becoming apparent. “A lot of people think it’s a ‘nice to have,’ but it’s no longer a ‘nice to have,’” Sebastian Builes, cofounder and chief executive at Arcum, a merchant-retention firm that uses AI, told …

July, 2024

-

26 July

Square Joins US Foods’ Check program and other Digital Transactions News briefs from 7/26/24

Square announced it has joined US Foods’ Check program, which offers technology to restaurants. Square is the point-of-sale payments unit of Block Inc. US Foods is a distributor to the dining industry. China’s UnionPay cards now total more than 240 million outside China, the company said in an update, with issuance in 82 …

-

25 July

Composable commerce for ISVs: Creating the blueprint for strategic growth

Steven Velasquez, Senior Vice President and Head of Partner Business Development – U.S. Bank | Elavon As consumer demand for a frictionless payment experience increases, ISVs that embed additional financial services into their offerings stand to win more market share in a progressively competitive software ecosystem. How ISVs decide to …

-

25 July

Kasheesh Brings a New Twist to Split Payments

Financial technology provider Kasheesh Inc. on Thursday launched a virtual card that allows consumers to split payments for online purchases across up to five existing credit, debit, and prepaid cards. The card is intended to provide an alternative to buy now, pay later loans. The Mastercard-branded card can be loaded …

-

25 July

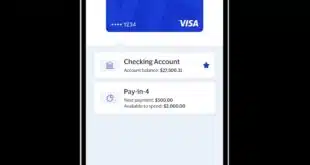

Card Issuer Marqeta Will Support Visa’s Flexible Credential

Marqeta Inc. early Thursday said it has become the first card-issuing platform to adopt technology announced earlier this year by Visa Inc. that lets cardholders toggle among a variety of payment methods for a single card rather than be restricted to the payment type indicated by the card itself. Oakland, …

-

25 July

Papaya’s Workforce Software and other Digital Transactions News briefs from 7/25/24

U.S.-based Papaya Global, which offers platforms for payroll and payments processing, said it will support payroll and other workforce software for Cegid, a Europe-based provider of cloud software for finance and human resources. American Express Co. announced updates to its U.S. Consumer Gold Card, including credits for spending at restaurants included in …

-

24 July

Fiserv Racks up Growth Via Strength in Merchant Services

Fiserv Inc.’s top brass early Wednesday celebrated a second quarter in which adjusted revenue jumped 7% and adjusted earnings per share grew 18%, but it was new programs and alliances—including one with Apple Inc.—that took center stage as the company presented its second-quarter results. Cash Flow Central, a banking alliance …

-

24 July

Tap-to-Pay And Value-Added Services Help Fuel Visa As It Pursues a New Interchange Settlement

Growth in contactless and peer-to-peer payments, e-commerce, and value-added services were among the highlights discussed with stock analysts late Tuesday during Visa Inc.’s third-quarter earnings call for the card company’s fiscal year 2024. Visa’s Tap-to-Pay contactless payments technology has penetrated multiple markets, accounting for 80% of all face-to-face Visa transactions …

-

24 July

Fortis Makes Acquisition and other Digital Transactions News briefs from 7/24/24

Fortis Payment Systems LLC acquired the NetSuite payments division of MerchantE Solutions Inc. Fortis said the acquisition will boost its position in embedded enterprise resource planning payments. Terms were not disclosed. Mastercard Inc. and JPMorgan Chase are two of eight companies the Federal Trade Commission issued orders to seek information about products that …

-

23 July

Digital Payments Have Plenty of Room for U.S. Growth, a Marqeta Report Says

Demand for digital-payment and embedded-finance technology is growing in the United States, especially among Gen Z and Millennials, says a report from payments platform Marqeta Inc. The demand is being driven largely by the lower adoption of contactless payments and mobile-banking apps in the U.S. compared to the United Kingdom …