Unattended payments continue to bear fruit for USA Technologies Inc. as the company said its connections increased 92.3% in its fiscal third quarter from a year ago. Malvern, Pa.-based USAT said its connections totaled 969,000 in the quarter ended March 31, up from 504,000. Its total number of customers, at …

May, 2018

-

8 May

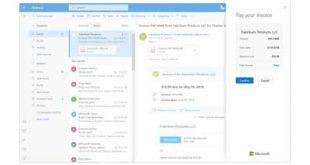

Microsoft Enables Email Users to Pay Billers Without Leaving Outlook

Microsoft Corp. is adapting its Microsoft Pay wallet to allow users of Outlook to pay bills and invoices they receive in the email program. The new feature, announced Monday at a company-sponsored developer conference, will become available to “a limited number” of users of Outlook’s Web-based service “over the next …

-

7 May

Global Payments Goes Camping in Its Quest for New Integrated-Payments Partners

Merchant acquirer Global Payments Inc. is teaming up with yet another company owned by private-equity firm Vista Equity Partners as it looks for new opportunities to integrate payment processing with software providers serving a wide range of businesses. Last week, Atlanta-based Global announced a deal with RA Outdoors LLC, which …

-

7 May

SignaPay’s PayLo Program Signs Reseller and other Digital Transactions News briefs from 5/7/18

Payments provider St. Louis Merchant Services announced it is offering the PayLo Cash Discount Progam from SignaPay Ltd. Fiserv Inc. has teamed with fraud-analytics firm Rippleshot to offer Card Risk Office, an early-detection service that allows client institutions to identify potential fraud anywhere from 30 days to 60 days before …

-

7 May

An Airline Group Is Developing a Payment System That Would Bypass the Card Networks

An airline trade group has teamed up with Germany’s Deutsche Bank to develop a payment system that would bypass the credit card networks, potentially saving users billions in interchange. The proposal comes from the International Air Transport Association, which says it has 280 members representing 83% of air traffic. The …

-

7 May

Syncapay’s Acquisition Ambition Begins With Disbursements

A new entry in the arena for payments-related acquisitions, Syncapay, is targeting specialists in disbursements and payouts. Plano, Texas-based Syncapay debuted last week with the intent to acquire payments companies that could benefit from shared services, while retaining the autonomy that differentiates them. “We are not looking at doing a …

-

7 May

A Disappointed Investor Sues Ripple, Alleging Its XRP Is a Security, Not a Digital Currency

Ripple Labs Inc. has notched a number of successes lately for its distributed-ledger technology, but now it finds its cryptocurrency, known as XRP, is caught up in a lawsuit that reflects a larger debate over whether such digital tokens constitute securities. Ryan Coffey, an investor who bought XRP in January …

-

4 May

Risk Levels Surge for E-Commerce And for Payment Processors, Finds ThreatMetrix

E-commerce attacks increased 93% in the first quarter of 2018 in comparison to the same quarter a year ago, finds the Q1 2018 Cybercrime Report from ThreatMetrix, a unit of LexisNexis Risk Solutions. Based on an analysis of 210 million attacks ThreatMetrix detected and stopped on behalf of its clients, …

-

4 May

The Same Old Problems Plague the ‘Pays’ As Adoption Levels Show ‘Signs of Slippage’

Ever since Apple Pay emerged in 2014, experts have scratched their heads over the general failure of contactless mobile wallets to catch on faster with U.S. consumers. Now comes research indicating how wallet sponsors might turn things around by focusing on what consumers are most looking for in wallet services …

-

4 May

Google Pay Coming to Browsers and other Digital Transactions News briefs from 5/4/18

Google announced that Google Pay users soon will be able to use the service to make purchases within the Chrome, Safari, and Firefox browsers. Once a card has been added to a Google Pay account, users don’t need to re-enter their payment info. If using Chrome, Google Pay can automatically …