PayPal Holdings Inc. has made another move in its efforts to leverage its Xoom cross-border payments platform for its stablecoin, PYUSD. The payments giant early Tuesday said Xoom users will be able to use PYUSD to settle money transfers they make through the service. The news comes just seven months …

November, 2024

-

19 November

58% of Spending Made with Debit Cards and other Digital Transactions News briefs from 11/19/24

Debit cards not using prepaid funds accounted for 58% of U.S. card spending in 2022, the Atlanta Fed noted in a review of a Federal Reserve Payments Study released last week. Credit cards were used for 36% of payments and 6% of payments were made with prepaid debit cards. Cantaloupe Inc. will serve as …

-

18 November

Lightspeed Rolls Out a Kitchen Display System; Fortis Adds a Voice Ordering Platform

Lightspeed Commerce Inc. has introduced a new kitchen display system it says will help restaurants address operational challenges, reduce operating costs, improve order accuracy, and enhance customer satisfaction. A key feature of the new kitchen display system (KDS), which can be integrated with Lightspeed’s point-of-sale platform, is the ability to …

-

18 November

Two San Antonio Venues Opt for Shift4 for Concession and Ticketing

Shift4 Payments Inc.’s determined push into venue point-of-sale transactions got another win with the announcement the payment company’s products will be used at the Frost Bank Center and Toyota Field venues in San Antonio. The number of Shift4 devices to be used at both locations was not disclosed. The Frost …

-

18 November

Priceline Picks Affirm and other Digital Transactions News briefs from 11/18/24

Buy now, pay later processor Affirm Inc. said it is expanding its partnership with Priceline to include online travel agency Priceline’s business-to-business platform, Priceline Partner Solutions. Canada-based processor Nuvei Corp. announced it has completed the process of going private after five years as a public company. Neon Maple Purchaser Inc., a unit of Advent …

-

15 November

Online Shoppers Love-Hate Relationship with Generative AI; Sift Releases New Fraud Benchmarking Metrics for E-Commerce

Despite 71% of online shoppers being unaware they are interacting with generative artificial intelligence, about half say they see value in the technology when it comes to personalizing the online shopping experience and would be willing to share personal data to receive a more customized shopping experience, says a recent …

-

15 November

Discover Grows Its International Presence Through a Pair-Up With Telered in Panama

Discover Global Network continues to expand its international business through a deal with Panamanian payment processor Telered S.A. Telered manages the Sistema Clave, or Clave System, which Discover says is the largest interbank network of ATMs and points of sale in Panama. In business for more than 30 years, Clave’s …

-

15 November

Celero Marks Another Acquisition and other Digital Transactions News briefs from 11/15/24

Payments provider Celero Commerce acquired Precision Payments. Celero said its total annual North America card processing volume is expected to exceed $28 billion with the addition. Terms were not disclosed. NCR Atleos Corp. said it will provide its Cashzone Network ATMs in United Kingdom-based grocer Waitrose stores. Payhawk Ltd. announced an integration with Mastercard …

-

14 November

Mastercard Plans to Tokenize All Online Transactions by 2030

Mastercard Inc. unveiled plans late Wednesday to tokenize card numbers for all online transactions globally by 2030. The move will make the need for physical card numbers, passwords, and one-time codes for online purchases obsolete, the network says. Tokenization masks in-the-clear card numbers with digits that would be indecipherable to …

-

14 November

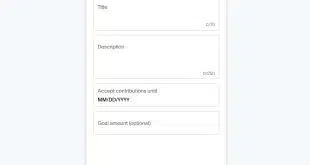

PayPal Dives into Shared Funding Efforts

PayPal Holdings Inc. is hoping to enable the power of community with a new funding service that enables multiple individuals to contribute to one account. Dubbed a “pool” by PayPal, the service means contributors can chip in to pay for group gifts, travel, special events, and other shared expenses. Announced …