Zelle, the person-to-person payment service from Early Warning Services LLC, said it will launch a consumer education campaign video series this month to help educate consumers how to spot and avoid financial scams, specifically imposter scams. Zelle, in a statement to Digital Transaction News, also said most Zelle transactions—99.9%—are without any …

Read More »In An About Face, Zelle Banks Issue Refunds to Users Victimized By Scams

Banks in Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have been issuing refunds to consumers duped by fraudsters into sending money using the network, according to a report Monday by Reuters. The reimbursements, which the banks have reportedly been paying out since June 30, represent a …

Read More »Western Union’s Paysend Deal And Other Digital Transactions News briefs from 10/31/23

The Western Union Co. announced customers will be able to send money via the company’s digital service directly to Visa and Mastercard cards through an integration with Paysend, a card-to-card payments platform. Lightspeed Commerce Inc. launched several new features including artificial intelligence-assisted menu creation, better insights into popular items, staff performance tools, …

Read More »Mastercard Revenue up 12% And Other Digital Transactions News briefs from 10/26/23

Mastercard Inc. posted strong third-quarter results of $6.5 billion in revenue, up 12% from $5.8 billion in the 2022 third quarter. The card giant’s net income of $3.2 billion increased 28% from $2.5 billion in the year-ago quarter. Mastercard cited cross-border payment volume growth of 21% in the quarter as one …

Read More »Expect Real-Time Payments Bloom And Other Digital Transactions News briefs from 10/19/23

Ninety-nine percent of large enterprises—those with annual revenue of $1 billion to $9.9 billion—expect to send real-time payments in the next five years, found the 2023 AFP Real-Time Payments Survey released by the Association for Financial Professionals and sponsored by The Clearing House Payments Co. LLC. It also found that 77% of …

Read More »Commentary: Today’s Payments Are Broken. Here’s What to Do About It

Most bankers know that today’s payments are broken. From keeping pace with evolving customer experiences, to navigating the changing regulatory environment, to overcoming competitive threats from nonbanks, many have become so frustrated they are debating whether to abandon some in-house payments channels entirely. Consumers, too, are becoming frustrated with the …

Read More »Varo to Anyone P2P Payments Debuts And Other Digital Transactions News briefs from 9/22/23

Varo Bank entered the peer-to-peer payments fray with Varo to Anyone, which allows Varo accountholders to send funds to anyone who holds a U.S. debit card. Varo says the service carries no fee. Mitek Systems Inc. announced it has agreed to offer its biometric-based identity verification technology to complement the credit-reporting agency Equifax Inc.’s …

Read More »Square Outage Disrupts Transactions And Other Digital Transactions News briefs from 9/8/23

Block Inc.’s Square and Cash App units began experiencing system outages late Thursday, according to news reports. Cash App’s outage reportedly affected peer-to-peer payments, cash-ins, and cash card transactions. At Square, engineers reported early Friday they were deploying a solution. Point-of-sale system maker iPOS Systems has enabled Tap to Pay on iPhone for U.S. …

Read More »Eye on P2P Payments: Hallmark Adds Venmo Gifting; Zelle Second Quarter Volume up 10%

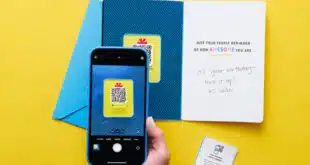

Sending cash with birthday cards in the mail is risky, but now Hallmark Cards Inc.’s service with Venmo makes it easier and presumably safer. The new Hallmark + Venmo line of cards includes a QR code inside the card that recipients scan to receive the funds to their Venmo accounts. …

Read More »Gen Zers Lead the Charge as Canadians Embrace Mobile Debit Transactions

In-store debit card payments made using mobile devices in Canada surged 53% during the 12-month period ended July 31, compared to the same period a year earlier, according to Interac Corp., Canada’s national debit network. In addition, e-commerce transactions made using a mobile device increased 17% year-over-year during the same …

Read More »