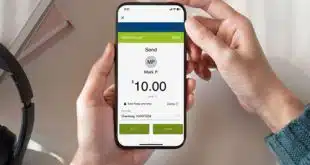

The Consumer Financial Protection Bureau early Friday said it has sued Early Warning Services LLC as well as Bank of America, JPMorgan Chase, and Wells Fargo, alleging the Zelle person-to-person payments network failed to protect consumers against fraud. The banks are three of the seven financial institutions that own Early …

Read More »Zelle Enlists Star Power in a Fraud Awareness Campaign

Zelle, the peer-to-peer payments service from Early Warning Services LLC, will put the detective powers of its S.A.F.E. Squad to work again with the help of actor Christina Ricci in a new education campaign on fraud and scams. This is the second year of the campaign and Ricci’s participation. This …

Read More »Visa Direct Will Define Real Time As One Minute—Or Less

Visa Inc.’s move to speed up its Visa Direct service to no more than one minute, starting in April, is likely to cement the global card network’s place in the payments industry’s steady movement toward real-time transfers, some observers say. The network, which announced the move early Thursday, says it …

Read More »Nuvei’s Google Pay Expansion and other Digital Transactions News briefs from 12/12/24

Canada-based processor Nuvei Corp. announced an expansion of its Google Pay offering to merchants throughout Latin America. The company already offers the wallet in the U.S., European, Asia-Pacific, and Australian markets. Grocery e-commerce platform eGrowcery said it and Forage, a payments provider that can process online EBT SNAP payments, are working on a service …

Read More »Diebold Nixdorf’s Windows 11 ATM Move and other Digital Transactions News briefs from 12/4/24

ATM maker Diebold Nixdorf Inc. said two bank clients in Central Asia are the first to launch ATMs using Microsoft Windows 11. Block Inc.’s trio of payments platforms—Square, Afterpay, and Cash App—processed a record 144 million consumer transactions over the Black Friday through Cyber Monday period, up 17% from the same time …

Read More »APP Fraud To Reach $7.6 Billion by 2028 in Six Countries, ACI Says

Authorized push payment fraud could reach $7.6 billion in six markets, ACI Worldwide Inc. says in its latest Scamscope report. Released Wednesday, the report looks at APP fraud in the United States, United Kingdom, India, Brazil, Australia, and the United Arab Emirates, all markets with real-time payments. APP fraud happens …

Read More »Celero Marks Another Acquisition and other Digital Transactions News briefs from 11/15/24

Payments provider Celero Commerce acquired Precision Payments. Celero said its total annual North America card processing volume is expected to exceed $28 billion with the addition. Terms were not disclosed. NCR Atleos Corp. said it will provide its Cashzone Network ATMs in United Kingdom-based grocer Waitrose stores. Payhawk Ltd. announced an integration with Mastercard …

Read More »Blackhawk Debuts eGift Card Links and other Digital Transactions News briefs from 11/14/24

Prepaid card platform Blackhawk Network launched eGift Card Links, which allows brands to let customers paste a link into an email, text, or social-messaging app. Recipients access the e-gift card by opening the link and can redeem it immediately. Judopay, a United Kingdom-based mobile-payments platform, said it is entering the North American …

Read More »Block Focuses on Using Loans, Afterpay, and Cash App to Power Its Growth

The big payments platform Block Inc. will remain focused on its Afterpay buy now, pay later offering, on its Cash App digital wallet, and on increasing access to Square Loans, said Block chief executive Jack Dorsey late Thursday during the company’s third-quarter earnings call. Dorsey stressed the key importance of …

Read More »Nearly Half of Consumers Say They’re More Satisfied With Their Card Issuer After Suffering Fraud, As Fraud Remains a Threat

Despite the ever-present threat of fraud, almost half of consumers tend to have a more positive opinion of their credit card issuer after becoming fraud victims, according to J.D. Power’s “U.S. Financial Protection Satisfaction Study,” released Thursday. Some 49% of credit card holders say they have a more positive impression …

Read More »