PayPal Holding Inc.’s top management early Tuesday wasted no time extolling the early returns on several initiatives the payments company has launched in recent weeks to reinvigorate growth at the 26-year-old company. Chief executive Alex Chriss, in office for barely more than a year, made it clear he is exercising …

Read More »Chopra Fires Back at Critics of the CFPB’s New Data-Privacy Rule

Rohit Chopra, director of the Consumer Financial Protection Bureau, spent his Sunday afternoon highlighting key elements of the CFPB’s new data-privacy rule and criticizing banking organizations that have targeted the rule. The assault on the regulation includes a lawsuit filed the same day the final rule, in development for more …

Read More »The CFPB Releases Its Data Privacy Rule for Open Banking

The Consumer Financial Protection Bureau has finalized its personal financial data-rights rule aimed at governing the sharing of consumer data through open banking. The new rule, released early Tuesday, will require financial institutions, credit card issuers, and other financial providers to share data at a consumer’s direction with companies offering …

Read More »Visa Tweaks Visa Direct Line up and other Digital Transactions News briefs from 10/18/24

Visa Inc. has restructured its money movement services under the Visa Direct portfolio, which now includes Visa B2B Connect, Currencycloud, Yellowpepper, and Visa Direct. Cash App, the peer-to-peer payment service and wallet from Square, said Lyft ride-share users can now pay for fares with Cash App. Truist Financial Corp. launched its Electronic …

Read More »Zelle Posts Strong 2024 First Half Growth

Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, announced early Thursday that consumers and small businesses sent $481 billion dollars over the network during the first half of 2024, a 28% increase from the same period a year ago. Zelle users sent $1.8 million per minute, $110 million …

Read More »Same-Day ACH Payments Mount As Nacha Reports a Robust 67.5% Growth in Volume

Faster payment volumes continue to mount in the U.S. market as Nacha, the regulatory body for the nation’s automated clearing house network, announced early Thursday same-day transaction volume grew 67.5% in the third quarter compared to the same period in 2023. That growth resulted in 355.2 million payments, compared to …

Read More »Stripe Returns to Crypto Support; Alchemy Pay Adds Samsung Pay To Its Wallet Offerings

Six years after dropping its support for cryptocurrency, Stripe Inc. is once again enabling its merchants to accept the digital money. As of Oct. 9, Stripe merchants can now accept USD Coin, a stablecoin that settles transactions in U.S. dollars. In the first 24 hours after launch, consumers from more …

Read More »Research Pins Down How Soon Real Time Payments Will be Routine

With the Federal Reserve’s FedNow service having debuted in July last year and The Clearing House Payments Co.’s RTP network in operation since 2017, just how soon can the U.S. payments industry expect widespread, routine exchange of real-time transactions? Answers to that question are beginning to emerge. According to a …

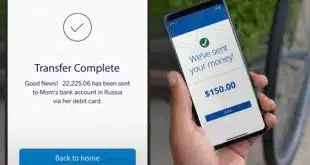

Read More »Two P2P Payments Providers Clear up What ‘Unauthorized’ Means

A fresh report from Consumer Reports finds that two of the four peer-to-peer payments companies it evaluated have cleared up the definition of “unauthorized” transactions pertaining to fraud. The publication last reviewed Apple Cash, Cash App, Venmo, and Zelle in 2022. The issue of what is an unauthorized P2P transaction gained …

Read More »Wero Ramps Up As a European Account-to-Account Payments Provider And Heads to the Point of Sale

European banks are beginning to roll out a new digital wallet called wero that initially provides account-to-account payments and is expected to be expanded to retail payments as well. If so, wero could prove to be a competitive threat to Visa Inc. and Mastercard Inc., which dominate European payments, raising …

Read More »