Consumers with PayPal accounts will be able to withdraw cash from, and deposit cash into, these accounts at participating U.S. Walmart Inc. locations, Walmart announced Thursday. The deal means PayPal accountholders will pay $3 per cash-in and cash-out transaction. San Jose, Calif.-based PayPal says this is the first time its …

Read More »ATM Surcharges Increase and other Digital Transactions News briefs from 10/10/18

Fiserv Inc. said it connected more than 100 banks and credit unions so far to the Zelle peer-to-peer payments network. The institutions are now live or will be going live soon, the company said. The average surcharge assessed by the ATM owner for an out-of-network transaction rose for the 14th …

Read More »Chase Adds Card Lock Feature and other Digital Transactions News briefs from 9/27/18

BNY Mellon has become the first bank client to sign a reseller agreement with Early Warning Services’ Zelle person-to-person payment network for tokenized disbursements to consumers. Zelle indicated earlier this year it would expand into disbursements as a potential field for fee-based payment services. Zelle also announced Dollar Bank now offers Zelle …

Read More »BlueSnap Now Processing In Australia and other Digital Transactions News briefs from 9/18/18

Processor First Data Corp. said it shipped its 1 millionth Clover point-of-sale sale device aimed mainly at small and mid-sized merchants; the device went to Friesen-Apotheken, a pharmacy chain based in Bad Malente, Germany. Payments platform BlueSnap has begun local processing for business-to-business and business-to-consumer companies in Australia. Buildium, a …

Read More »Rambus Token Gateway Receives Visa OK and other Digital Transactions News briefs from 9/12/18

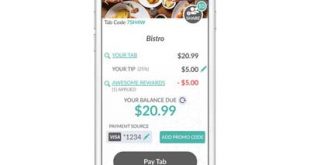

Rambus Inc. announced its token gateway for e-commerce is one of the first such services to be certified by the Visa Ready program. The gateway streamlines links to the Visa Token Service to tokenize payment credentials for merchants, payment service providers, and merchants. Mobile-payments specialist Glance Technologies Inc. said its …

Read More »GAO Calculates Equifax Breach Impact and other Digital Transactions News briefs from 9/11/18

Georgia State University announced that the new Georgia FinTech Academy, a talent-development initiative involving Georgia’s 26 public institutions of higher learning, will have physical locations at Georgia State and in Atlanta’s Buckhead neighborhood. The FinTech Academy is supported by the Atlanta-based American Transaction Processors Coalition. One year after credit-reporting agency Equifax Inc. disclosed its …

Read More »Fingerprint Scanning Will Have to Move Over for Facial And Voice ID, Research Says

With mobile-payments volume increasing while confidence in passwords slumps, researchers are predicting big growth for mobile authentication via biometric technology such as facial or voice recognition. In one forecast, from the United Kingdom-based firm Juniper Research, the number of mobile users authenticating themselves by such technology will grow over the …

Read More »Mangum Leaving Global Payments and other Digital Transactions News briefs from 8/31/18

Processor Global Payments Inc. announced its president and chief operating officer, David Mangum, plans to leave. No details were immediately available about why or when Mangum will depart. Chief executive Jeff Sloan and Cameron Bready, senior executive vice president and chief financial officer, have extended their employment agreements through August …

Read More »Western Union Expands Mobile And Online Transfers to Three More Global Regions

The Western Union Co., which has been expanding its digital footprint for several years, announced a major move on Wednesday into Asia, Latin America, and the Middle East. Online and mobile money transfers will start over the next few weeks in Malaysia and Singapore, the company said, with service already …

Read More »Cash Pick-Up Deal With Ria Brings PayPal’s Xoom to 60 More Countries

Xoom, the online money-transfer service that PayPal Holdings Inc. acquired in 2015, will enter 60 more countries and expand in 26 more under a deal announced Tuesday with Euronet Worldwide Inc.’s Ria money-transfer subsidiary. The pact enables Xoom payment recipients to pick up cash transfers from senders, most of whom …

Read More »