Now officially a year old, Zelle is steadily gaining momentum. San Francisco-based Bank of the West, the 29th largest bank in the country ranked by assets, announced Thursday it will join the bank-controlled person-to-person payment network, which already claims some of the biggest financial institutions in the country. Also this week, …

Read More »Overtaking Venmo and other Digital Transactions News briefs from 6/13/18

Investors jumped on shares of Netherlands-based payment processor Adyen Wednesday after the company priced its initial stock offering on the high end of its expected range at €240 ($282.48) per share. As of late morning Eastern time, the stock had more than doubled to €480.30 ($565.31) per share, prompting talk …

Read More »Generation Z Emerges With a New Way of Thinking About Payments

Generation Z is about to become a major force in financial services and payments, and that will change how payments providers market their services to them. That assertion, in the “Technologies Influencing Generation Z Payments Adoption” report released this week by Javelin Strategy & Research, is based, in part, on …

Read More »COMMENTARY: In the Eyes of the CFPB, We Are All Prepaid Now

A deep dive into the more than 2,000 pages of the Consumer Financial Protection Bureau’s regulations covering the prepaid market shows that the CFPB is trying to extend uniform consumer protections to as many payment types as possible. That includes unauthorized or disputed transactions for all financial-access devices regardless of …

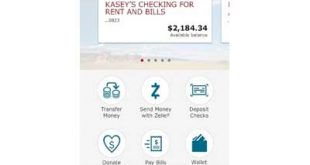

Read More »Wells Fargo’s Mobile App Moves Payments to Center Stage, Even Before the Log-in

Ever since banks, merchants, and tech companies first introduced mobile services, they’ve looked for ways to entice more usage by streamlining the way consumers interact with little screens. Now Wells Fargo & Co. has decided to put frequently used payments services on the home screen of its mobile app, before …

Read More »Syncapay’s Acquisition Ambition Begins With Disbursements

A new entry in the arena for payments-related acquisitions, Syncapay, is targeting specialists in disbursements and payouts. Plano, Texas-based Syncapay debuted last week with the intent to acquire payments companies that could benefit from shared services, while retaining the autonomy that differentiates them. “We are not looking at doing a …

Read More »Square Reports Advances With Larger Merchants And Double-Digit Growth in Key Metrics

Square Inc. reported a strong first quarter late Wednesday, but you wouldn’t know it on Wall Street, where its shares were trading down slightly Thursday morning at just over $47. It closed at $48.70 Wednesday. Despite double-digit increases year-over-year in gross payment volume and net and adjusted revenue, the San …

Read More »Beyond P2P: As Rival Venmo Moves In-Store, Zelle Eyes a Big Move on Disbursements

Since its official launch last June, Zelle has been all about carving out a healthy piece of the burgeoning person-to-person payments market for financial institutions. Now it’s promoting another service that leverages its network but could prove far more lucrative: disbursements. When companies, associations, or other organizations need to pay …

Read More »After an Initial Hit, PNC Bank Cuts Its Zelle P2P Fraud

PNC Bank customers like Zelle, but fraudsters liked the person-to-person payments service a little too much after PNC rolled it out last July, according to a bank executive. Paul Trozzo, senior vice president and product group manager, on Tuesday dubbed Zelle “very successful” for the Pittsburgh-based bank, a unit of The …

Read More »How Square’s Deal for Weebly Sets the Stage for Expansion to Bigger Merchants

Since its founding nine years ago, Square Inc. has focused on simplified checkout options and software for small brick-and-mortar merchants. With its acquisition of Weebly Inc., announced late Thursday, San Francisco-based Square is not only staging a major expansion into e-commerce, it’s also laying the groundwork for a significant outreach …

Read More »