The evolution of artificial-intelligence tools toward countering credit card transaction fraud took another step with the launch of a new AI workflow from Nvidia Corp. Meanwhile, the RTP network from The Clearing House Payments Co. LLC finds that 90% of organizations’ counterparties whom they send to or receive instant payments …

October, 2024

-

28 October

Shift4 Puts Its Weight Behind Cryptocurrency as a Payment Option

Shift4 Payments Inc. early Monday gave cryptocurrency a big shot in the arm as a payment option with the announcement it will support digital currencies across its merchant network. Shift4 will support coins including Bitcoin, Ethereum, and Solana SOL, as well as US Dollar Coin and other major stablecoins, …

-

28 October

Chopra Fires Back at Critics of the CFPB’s New Data-Privacy Rule

Rohit Chopra, director of the Consumer Financial Protection Bureau, spent his Sunday afternoon highlighting key elements of the CFPB’s new data-privacy rule and criticizing banking organizations that have targeted the rule. The assault on the regulation includes a lawsuit filed the same day the final rule, in development for more …

-

28 October

Mastercard And Bill Payments and other Digital Transactions News briefs from 10/28/24

Mastercard Inc. has launched Bill QKr, a service supporting merchants and acquirers in accepting and more quickly processing card-based bill payments. 2C2P, AXS, CardUp, Curacel, and FitBank are among the first to adopt the new service. Real-time cross-border payments platform Nium launched Nium Verify, a service the company says can verify both business …

-

25 October

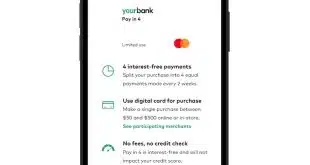

Mastercard Goes Networkwide With Its Installments Program

Mastercard Inc. announced early Friday it is expanding its Installments payments program to all eligible digital points of sale within its network in the United States. The expansion will enable merchants, financial service providers, payment processors, and digital-wallet providers to present installment offers to consumers through any eligible credit card …

-

25 October

Elavon Debuts a Single Gateway Platform

With merchants demanding simpler yet more encompassing payment gateway capabilities, acquirer Elavon launched its Elavon Payment Gateway, starting first with small and mid-size businesses. The new Elavon gateway, announced Thursday, takes a cloud-based, omnichannel approach, offering “features and functionality from existing gateways,” Pari Sawant, Elavon’s chief product officer, tells Digital …

-

25 October

Bancorp’s Profit up 2.8% and other Digital Transactions News briefs from 10/25/24

The Bancorp Inc., which provides payments and other financial services to fintechs, reported September quarter-net income of $51.5 million, up slightly from $50.1 million a year ago. Gross dollar volume on prepaid and credit cards grew 15% to $37.9 billion. Payment fees from prepaid and debit cards, automated clearing house …

-

24 October

How the CFPB’s Data Privacy Rule for Open Banking Could Impact Merchants’ Swipe Fees

While the Consumer Financial Protection Bureau is being sued over its data-privacy rule, merchants remain optimistic the regulation will help them reduce the impact of swipe fees by making account-to-account payments widely available at the point of sale. The key is open banking, which paves the way to developing payment …

-

24 October

BlueSnap’s Many Integrations and other Digital Transactions News briefs from 10/24/24

Payments provider BlueSnap launched its Channel Partner Program, through which it has signed eight system-integration partnerships in the U.S., Canadian, and U.K. markets. Visa Inc. said it is working with governing entities around the world to help them create digital access to government services for their citizens. Mastercard Inc. announced it has extended its …

-

23 October

Eye on Pay by Bank: Dwolla Readies Plaid Integration; Trustly Forecasts 33% Americas Growth

Account-to-account payments provider Dwolla Inc. is readying itself for more pay-by-bank business with an expanded integration to open-banking platform Plaid Inc. Des Moines, Iowa-based Dwolla says the integration, which is scheduled to go live in early 2025, will make Plaid’s instant account-verification and risk-assessment services available in Dwolla’s pay by …