Discover Financial Services reported its payment-services volume totaled $69.7 billion in the third quarter, up 11% year-over-year. Volume on the Pulse debit network increased 16% to $55 billion owing to larger average spending due to the pandemic and to the lift from stimulus funds.Payments provider PaymentCloud Inc. said it acquired contactless technology startup …

October, 2020

-

21 October

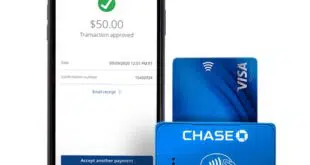

Eye on Acceptance: Visa Rolls Out Tap to Phone; Chase Launches QuickAccept

Visa Inc. on Wednesday announced the rollout in 15 geographic markets of Visa Tap to Phone, which allows consumers to initiate a transaction simply by tapping a contactless card to a merchant’s NFC-enabled mobile device. Tap to Phone is now live in numerous countries throughout Europe, Middle East, Africa, Asia …

-

21 October

PayPal Dips into Crypto and other Digital Transactions News briefs from 10/21/20

PayPal Holdings Inc. announced a service that allows account holders to buy, hold, and sell cryptocurrency directly from their account. The company also said it will make cryptocurrency available as a funding source for purchases at the 26 million merchants worldwide that accept PayPal.Payments provider FIS Inc. said it added pharmacy chain Walgreens …

-

20 October

QR Codes Reach the Next Stage of Development for Payments: Fraud Detection

With merchant adoption of contactless payment solutions accelerating due to the Covid-19 pandemic, Incognia, a provider of fraud-detection applications, announced an app Tuesday to detect Quick Response code fraud. The application uses location behavioral biometrics to create a digital fingerprint for the consumer’s identity. It uses the buyer’s real-time and …

-

20 October

Transaction Pricing Levels Out, According to a New Strawhecker Report

Last conducted in 2016, the latest Third-Party Processing Pricing Benchmark Study from The Strawhecker Group indicates that debit and credit card transaction pricing appears to have leveled off. The average value of an IP-connected front-end authorization and capture action in 2020 is $0.016 for jumbo wholesale acquirers, or those with …

-

20 October

Graylin’s and Wallner’s New Venture and other Digital Transactions News briefs from 10/20/20

Payments industry veterans Will Graylin and George Wallner launched a fundraising campaign on Indiegogo for OV Valet, their new company that wants to offer Superkey, a fob that uses near-field communication and magnetic secure transmission technology, to enable tap-and-pay payments.Payments-technology provider VoPay International Inc. said it is working with Visa Inc. to integrate the …

-

19 October

Ziosk Responds to Covid’s Impact on Restaurants With More Point-of-Sale Technology Products

Though the restaurant industry has taken a hit during most of 2020 because of Covid-19 countermeasures, that doesn’t mean it doesn’t need new technology and services. That’s why Ziosk Inc., a Dallas-based point-of-sale technology provider, accelerated its development schedule this year and released a suite of new products. Now, in …

-

19 October

Billtrust to Go Public and other Digital Transactions News briefs from 10/19/20

Billtrust, a provider of accounts-receivable software for businesses, said it will go public at a valuation of $1.3 billion through a merger with South Mountain Merger Corp., a publicly traded special purpose acquisition company, or SPAC. Going public via a SPAC has become an increasingly popular option in recent months.In …

-

16 October

Square Releases an API to Allow Its Terminal to Ease Acceptance of Contactless Payments

Much has been written about the need for merchants to adopt various forms of contactless payments to suit jittery customers and cashiers in the midst of Covid-19, but often the conversion to touch-free transactions is easier said than done. In response, Square Inc. late Thursday unveiled an application programming interface …

-

16 October

Covid-19 Prompts the PCI Council to Take a Flexible Approach to Its Security Standard

Because of Covid-19, many employees who have access to payments data are working from home, making it awkward if not impossible for data-security assessors to conduct onsite inspections. In response, the PCI Security Standards Council says it plans to make the next version of its data-security standard more reflective of …