Annual stockholder meetings usually are staid affairs involving such exciting matters as appointing a company’s auditing firm, but the upcoming meeting for vending machine payments provider USA Technologies Inc. could be a real barn burner. The months-long battle between Malvern, Pa.-based USAT’s management and board on the one side and …

March, 2020

-

5 March

Perk Adds Alipay Support and other Digital Transactions News briefs from 3/5/20

Perk Labs Inc. announced an agreement with Alipay that will enable Alipay users to make payments on the Perk platform.EVO Payments Inc. said it will offer the Nexgo Inc. N5 Android smart point-of-sale terminal.Certemy Inc., a professional certification and licensing management platform, introduced new payment gateway options, including Stripe Inc., PayPal Holdings Inc., …

-

5 March

Keeping Merchants PCI-Compliant Is Becoming Tougher, Survey Finds

Independent sales organizations are increasing their use of non-compliance fees for merchants that don’t adhere to PCI Security Standards Council requirements, with 23% of ISOs surveyed for the ControlScan/MAC 2020 Acquiring Trends Report saying they assess these fees. That’s up from the historic range of 17% to 18%. The report, …

-

4 March

Ant Financial Buys a Stake in Klarna, Lending Impetus to Online Installment Payments

Klarna Bank AB, a leading exemplar of the trend toward offering installment-plan payments online and at the point of sale, has received backing from Ant Financial Services Group in a deal that cements an existing alliance between the two companies and could add considerable propulsive force to Klarna’s relatively new …

-

4 March

Bluefin Device Encryption Roster Grows and other Digital Transactions News briefs from 3/4/20

Bluefin Payment Systems LLC said several devices were added to its PCI-validated point-to-point encryption listing.Forte Payment Systems, a unit of CSG International Systems Inc., launched BillPay, a billing product that features security enhancements, the ability for users to pay online, via kiosk, or in person, and other enhancements.Installment-payment specialist Splitit Payments Ltd. said …

-

3 March

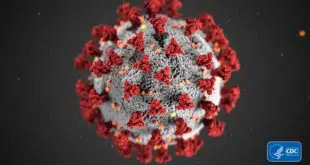

With Visa Issuing a Revenue Warning, the Coronavirus Takes a Further Toll on Payments Companies

With some of its payments cohorts already having warned the coronavirus would hurt their businesses, it was no surprise Visa Inc. joined the crowd Monday in forecasting reduced cardholder spending would translate into lower revenues. More signs of growing concern about the impact of the virus, officially named Covid-19, on …

-

3 March

Eye on Acquisitions: Fiserv Acquires ISO MerchantPro Express; RevSpring Adds Loyale Healthcare

After a more than 10-year relationship with MerchantPro Express LLC, processor and banking-services provider Fiserv Inc. is bringing the Melville, N.Y.-based firm in house with an acquisition of the independent sales organization. Announced Tuesday, the deal sees the long-time partner—likely with First Data Corp., which Fiserv bought last year—acquired as a …

-

3 March

Shazam To Offer TCH’s Real Time Payments and other Digital Transactions News briefs from 3/3/20

Debit network Shazam Inc. said it will offer The Clearing House Payments Co. LLC’s Real Time Payments service to its member financial institutions.POS Supply Solutions said it acquired Paper-Net, a point-of-sale consumables supplier, earlier this year. Terms were not disclosed. Paper-Net will take on the POS Supply Solutions branding.Professional Data Solutions Inc. (PDI), …

-

2 March

USAT Names CEO and other Digital Transactions News briefs from 3/2/20

Donald W. Layden Jr. has been appointed chief executive of USA Technologies Inc., a specialist in unattended payments. Layden, who has been serving as interim CEO since October, will continue to serve on the company’s board but will step down as executive chairman. Among other moves at the board and executive …

-

2 March

COMMENTARY: Worldline And Ingenico: The What, the Why, And What’s Next? Part II

The combination of the French payments colossi Worldline S.A. and Ingenico Group S.A. spans multiple adjacent, but historically distinct, markets across the payments value chain. Issuer processing has been an oligopoly of ponderous, industrial-strength scale players such as Worldline, FIS, Fiserv/First Data, Total Systems, SIA/SSB, Nets, and Evry/Tieto. The traditional …