Barely more than a year after the Federal Reserve launched its FedNow platform, banks and service providers are finding ways to bring real-time payment capability to niche businesses. The latest example emerged early Tuesday with an announcement that Cross River Bank, a technology-oriented financial institution, is working with payments platform …

July, 2024

-

9 July

Skim Swipe’s POS Role and other Digital Transactions News briefs from 7/9/24

Wireless and cybersecurity developer Berkeley Varitronics Systems Inc. launched Skim Swipe, a tool that can help detect card skimmers hidden in point-of-sale terminals. Galileo Financial Technologies, a payments-technology platform, announced it is offering wire-transfer capability via an application programming interface that links clients of Community Federal Savings Bank to the Federal Reserve’s …

-

8 July

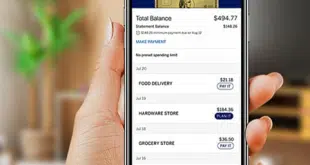

Issuer-Provided Installment Plans Are Catching up to Traditional BNPL Plans

Issuer-provided installment plans, such as American Express Plan It, My Chase Plan, and Mastercard Installments, are on par in popularity with in-store installment offers, finds Auriemma Group’s The Payments Report. American Express Co. was among the first issuers offering its own buy now, pay later plan, having launched it in …

-

8 July

Discover Unveils Balance+ to Offer Overdraft Protection on Debit Cards

Consumers may be well acquainted with the concept of overdraft protection when writing checks, but early Monday Discover Financial Services said it is extending the service to its debit cards. Cardholders who hold the company’s Cashback Debit Checking account are eligible for the new service, called Balance+. “With Balance+ we …

-

8 July

Fiserv Small Business Index Dips and other Digital Transactions News briefs from 7/8/24

Fiserv Inc.’s Small Business Index dipped four points in June to 140 amid a slowdown in consumer spending. Lower average tickets helped bring the separate transaction index down to 111 from 113 in May. Canada-based Digital Commerce Payments announced it has closed on its $1.5-million acquisition of the product information management business of Jasper …

-

3 July

Coinbase Wins a Federal Contract to Store Digital Assets

Cryptocurrency exchange and management provider Coinbase Inc. has won a $35.5-million contract to safeguard and trade digital assets on behalf of the U.S. Marshals Service. The Service, a unit of the U.S. Department of Justice, is responsible for asset forfeitures arising from federal legal cases, including cases that involve recovery …

-

3 July

Canadian Processor Helcim Looks to Draw More Partners With a Revenue Split

The Canada-based payments provider Helcim Inc., which like many processors works with a range of third-party partners, said late on Tuesday it is stepping up that collaboration to allow these integration partners to share in the company’s transaction revenue. Helcim figures revenue sharing will help attract yet more developers and …

-

3 July

Netevia Lines up $120 Million in Funding and other Digital Transactions News briefs from 7/3/24

Payments provider Netevia Group LLC said it raised up to $120 million committed and uncommitted capital from private investment firm WhiteHorse Capital. Ant Group and Mastercard Inc., and 12 other Ant payment partners have extended the International Consumer Friendly Zones program to Chengdu and Chongqing because inbound tourist travel is increasing in the region. They launched …

-

2 July

How the Supreme Court Has Set up an Intense Struggle Over Sellers’ Debit Card Costs

Decisions from the U.S. Supreme Court are supposed to settle matters, but a verdict the high court delivered early Monday has the potential to stir up debit card pricing questions for some time to come, some observers say. The justices, in a 6-3 decision, ruled a case brought by a …

-

1 July

Contactless May At Some Point Include Functions Beyond Payment, the NFC Forum Says

Contactless transactions were supercharged by the pandemic, and now slightly more than half of U.S. cardholders are using the technology when they pay with either cards or wallets, according to Mastercard Inc. research. With that kind of momentum behind them, researchers are looking at ways to expand near-field communication technology, …