365 Retail Markets LLC, a provider of self-service commerce technology, has entered into an agreement to acquire Cantaloupe Inc. in an all-cash deal for $848 million in a deal that will take Cantaloupe private. Cantaloupe shareholders will receive $11.20 per share, a 34% premium. The deal is expected to close …

June, 2025

-

12 June

The CCCA Goes Into Limbo As a ‘Clean’ GENIUS Bill Advances

Efforts to attach the Durbin-Marshall Amendment to the proposed GENIUS Act, a bill to regulate stablecoins, have failed. The Senate moved late Wednesday to advance the stablecoin bill without any amendments. Efforts to attach the amendment, which is the latest version of the Credit Card Competition Act, to the GENIUS …

-

12 June

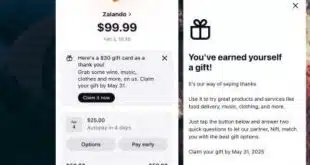

Eye on BNPL: Klarna Enlists Nift for Unique Offers; Dick’s Sporting Goods Renews Affirm

Buy now, pay later specialist Klarna AB is working with gift card platform Nift to boost customer engagement while retailer Dick’s Sporting Goods says it will renew its buy now, pay later deal with Affirm Inc. In the partnership announced Thursday with Nift, Klarna will be able to create gift …

-

12 June

BlueSnap On Board with FlightLogger and other Digital Transactions News briefs from 6/12/25

FlightLogger, a provider of software for flight training, has chosen BlueSnap Inc. as its payments provider globally. Gross proceeds to Circle Internet Group Inc. from its recent initial public offering came to $1.2 billion, a total that includes an agreement by underwriters to purchase an additional 5.1 million shares of Class A common stock …

-

11 June

PNC Launches an Acceptance App for Micro-Merchants

PNC Bank early Wednesday announced the launch of PNC Mobile Accept, a card-acceptance solution for micro-merchants. The app allows very small merchants to accept card payments using their mobile phones or tablet computers without a requirement for external hardware and without paying monthly subscription fees, the bank says. The app …

-

11 June

Circle Allies With Matera to Push Stablecoins Into Routine Usage

Circle Internet Group Inc. is working with Matera Inc., a developer of banking technology, in a move aimed at speeding adoption of stablecoins by individuals and companies, the two firms announced early Wednesday. In the collaboration, Matera will integrate its Digital Twin real-time ledger with Circle’s platform to support routine …

-

10 June

Friction Hobbles Toll Payments, a Study Finds, While PayRange Brings Cashless Payments to More Laundromats

Friction when attempting to pay a past-due road toll online is the leading reason consumers don’t pay overdue tolls, not an unwillingness to pay, says a report from PayNearMe Inc. Among the key findings in the report from the Santa Clara, Calif-based fintech is that 39% of drivers reported difficulty …

-

10 June

Eye on Point of Sale: PAR Engagement Debuts; Global’s Genius for Retail Released

Competition at the point of sale is just as tough behind the counter as in front. Two payments companies separately are launching new products they hope will give them an edge. PAR Technology Corp. released PAR Engagement, a portfolio of products meant to help enterprise restaurants win over more customers, …

-

10 June

Sezzle Sues Shopify Over Antitrust Allegations and other Digital Transactions News briefs from 6/10/25

Buy now, pay later platform Sezzle Inc. has sued Shopify Inc., alleging federal and state antitrust violations related to actions Sezzle says “stifle competition for [BNPL] service options on Shopify’s e-commerce platform.” The action was filed in the U.S. District Court for the District of Minnesota. The Shopify platform will adopt a feature from …

-

9 June

Synchrony And OnePay Team Up for a Walmart Credit Card Program

OnePay, a New York City-based fintech, is partnering with Synchrony Financial to launch a credit card program for Walmart Inc. The program, which will debut in the fall, will offer a general-purpose Mastercard credit card and a private-label Walmart card. Walmart expects the deal to provide a better customer experience when …