Prepaid payments platform Blackhawk Network said it is working with customer-engagement provider Extole to enable digital rewards and incentives for Blackhawk client merchants. U.S.-based Beame Technologies Inc. said it is working with authentication platform LISNR to offer BeamPay, a mobile-payments service, in Cabo Verde, Africa. U.S.-based business-to-business payments platform Balance said it is working with Hokodo, …

October, 2023

-

23 October

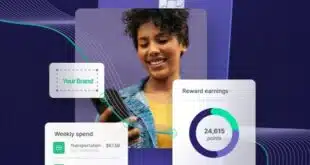

Rewards And Loyalty to Brands Still Drive Consumer Credit Use, Marqeta Finds

While rewards are the biggest reason consumers choose a credit card, cardholders believe issuers have more room for improvement when developing rewards programs, especially when it comes to personalization, according to Marqeta Inc.’s 2023 State of Credit report. The report reveals that 58% of consumers surveyed cited rewards as the …

-

23 October

Visa’s AR Manager And Other Digital Transactions News briefs from 10/23/23

Visa Inc. announced it will start a pilot in November for Visa AR Manager, a platform intended to automate more functions in commercial card acceptance. PayNearMe, a specialist in payments for iGaming and sports betting, will add to its MoneyLine platform the “Cardless Cash at ATM” feature from NCR Atleos Corp. …

-

20 October

AmEx Puts Its Pandemic Exposure Firmly in the Past

Card companies with a heavy exposure to travel and entertainment spending took a beating during the pandemic, but that’s ancient history now so far as American Express Co. is concerned. The T&E giant early Friday reported its sixth consecutive quarter of record revenue, backed by strong cardholder spending and new …

-

19 October

Discover Looks to a Resolution of Regulatory And Merchant Pricing Snafus

The top management at Discover Financial Inc. said early Thursday its issues with regulatory compliance and merchant overcharges continue to cast a shadow over the company but could be on the way to being solved. The problems, which included misclassification of merchants resulting in overcharges for card acceptance, came to …

-

19 October

BNPL Is Broadening Its Audience To Include Financially Strong Borrowers, J.D. Power Finds

The audience for buy now, pay later loans is widening to include financially healthy consumers who don’t need the extended buying power BNPL loans provide. The reason, according to a report citing J.D. Power’s 2023 BNPL Satisfaction Study, released in August, is reasonable repayment terms. While some 28% of U.S. …

-

18 October

On The Fly Taps BYOD for a New Hospitality POS Product

On The Fly POS’s latest product, called Ground Control, is making it easier for hospitality merchants to use their own devices for ordering and table management. The new app, with versions for both iOS and Android mobile devices, enables merchants to use their own hardware with an integrated software app …

-

18 October

Health iPASS’s New Service And Other Digital Transactions News briefs from 10/18/23

Health iPASS launched Health iPASS Cloud Payments, a processing service for health-care providers. Fiserv Inc. said it is leveraging its merchant-acceptance and card-issuing technology to ease embedded finance for client financial institutions. Metropolitan Commercial Bank said it will deploy cloud-based technology from Finzly to support payment processing via FedNow, Fedwire, and the automated …

-

17 October

Stax Adds Atlantic-Pacific Processing to Boost Its Multichannel Offering

Stax Payments has acquired payment-technology provider Atlantic-Pacific Processing Systems (APPS) for an undisclosed sum. The acquisition is expected to enable Stax to create a new end-to-end payments platform that includes an enhanced multi-channel offering, improved data reporting, and additional customization capabilities. “Our partners and customers want a simple, secure, multichannel …

-

17 October

Eye on Consumers: Organized Fraud Is up 44%; Holiday Spending Could Exceed Pre-Pandemic Levels

With the fourth quarter under way, fraudsters are increasing the sophistication of their attacks while consumers are gearing up for a busy holiday-shopping season, albeit with different goals. First, a new report from Au10tix, an Israel-based identity verification and management provider, found a 44% increase compared to preceding quarters in …