Visa Inc. may be readying a lower cap on credit card surcharges—moving from 4% to 3%—in April, but there’s no guarantee it will happen then. While a bulletin sent to large acquirers says the change to the brand rules will go into effect April 15, its implementation could be delayed, …

March, 2023

-

3 March

A Looming Capitol Hill Meetup Triggers A Renewed Assault on Efforts to Cap Credit Card Costs

As industry lobbyists prepare to converge on Capitol Hill next week, payments interest groups are issuing salvos designed to move the argument over limits on credit card acceptance costs in their favor. One such advance move came Thursday with an email campaign launched by the Electronic Payments Coalition citing a …

-

3 March

Modern Treasury’s Cross Border Payments Plan And Other Digital Transactions News briefs from 3/3/23

Payments-technology provider Modern Treasury and Silicon Valley Bank launched what they call a global payment solution to let clients of the two companies send cross-border payments at lower than prevailing costs and using local automated clearing house networks. SpecTrust Inc., whose Trust Cloud offers fraud protection for online transactions, said it has …

-

2 March

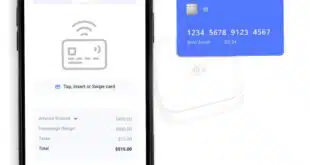

Eye on Payment Tech: Repay’s Volume Rises 25%; CardFlight’s Merchant Base Swells to 125,000

Payment technology provider Repay Holdings Inc. has high hopes in 2023 for two new business segments—Consumer Payments and Business Payments—as its posts $6.6 billion in processed card volume for 2022. In related news, CardFlight, developer of SwipeSimple, a mobile point-of-sale service, hits a record merchant count of 125,000. Repay’s plans …

-

2 March

CFPB’s BNPL Report And Other Digital Transactions News briefs from 3/2/23

“While many [buy now, pay later] borrowers who we observed used the product without any noticeable indications of financial stress, BNPL borrowers were, on average, much more likely to be highly indebted, revolve on their credit cards, have delinquencies in traditional credit products, and use high-interest financial services such as …

-

1 March

FIS’s Worldpay Joins With GoDaddy to Enable Multichannel Commerce for Small Sellers

The major processor FIS Inc. said early Wednesday it will work with Web registrar GoDaddy Inc. to offer processing to small and micro merchants for online and in-person transactions. The new service, called Commerce 360, will rely on FIS’s Worldpay processing unit and aims to help sellers reach customers through …

-

1 March

Elo Adds Tap to Pay Tech And Other Digital Transactions News briefs from 3/1/23

Felix announced its Terminal Tap to Pay technology has been integrated with the Android-based M50 Mobile Computer from Elo, enabling contactless payments on the Elo device. The move follows Stripe Inc.’s move last week to launch Tap to Pay for Android technology in six countries, including the United States. Payments provider ACI Worldwide Inc. reported …

February, 2023

-

28 February

Thryv Enhances Its Platform With Tap-to-Pay And Document Capabilities

Thryv Holdings Inc., a fintech credit card issuer and provider of small-business management software, has rolled out a suite of new apps for its platform, including tap-to-pay. The new features will enable small businesses to speed payments, streamline document management, and improve communications, Thryv says. Users of Thryv’s platform can now …

-

28 February

Shift4 Looks to Close on a European Processor As It Enters 2023 With Momentum

If any doubt remains that payment processors are rebounding strongly from the pandemic and all the restrictions it brought with it, Shift4 Payments Inc. likely dispelled it with the final-quarter 2022 results it posted early Tuesday. And if there’s a cloud on its horizon, it’s the waiting time the company …

-

28 February

Klarna’s Loss Widens And Other Digital Transactions News briefs from 2/28/23

Buy now, pay later provider Klarna AB said its 2022 loss of 10.47 billion krona ($1 billion) grew on its 2021 loss of 7.1 billion krona ($680 million). This comes amid growth in 2022. The United States became Klarna’s largest market in December. Also, Klarna will begin collecting late fees from United Kingdom consumers who miss a payment, …