Merchant interest in accepting cryptocurrencies continues to expand, with headline progress stemming from high-end luxury-goods segments. The latest example comes from ECD Auto Design, a Kissimmee, Fla.-based dealer in restored luxury cars. The company on Thursday announced it is accepting crypto for vehicle purchases. ECD’s move comes as digital currencies …

Read More »Opponents Ask for Summary Judgement in Their Legal Battle to Overturn Illinois’s Interchange Law

Plaintiffs seeking to overturn Illinois’s interchange law filed a motion for summary judgement earlier this week and requested that the state’s attorney general drop the case to enforce the law, which is scheduled to go into effect July 1. A motion for summary judgment asks a court to decide a …

Read More »How Business Groups Are Pushing for Stablecoin Acceptance

A leading merchant association and a group representing stablecoin interests early Thursday threw their weight behind efforts to bring stablecoins into the payments mainstream in the United States. The move by the Merchant Payments Coalition and the Payment Choice Coalition seeks to “promote their shared goals of enhancing innovation, competition, …

Read More »The EPC Takes Aim at the CCCA And Illinois’s Interchange Law

The Electronic Payments Coalition has launched the latest salvo in its offensive against legislation seeking to regulate credit card interchange. This time the thrust takes aim at federal and state legislative efforts. At the federal level, EPC executive chairman Richard Hunt said during a press conference late Wednesday morning the …

Read More »Observers And Lawmakers Handicap the CCCA’s Chances As It Heads Back to Congress

With expectations growing that the Credit Card Competition Act will soon be reintroduced in Congress, proponents of the bill feel its prospects for passage are better than ever. Helping fuel this optimism is growing bipartisan support for the bill, proponents say. “The Senate Judiciary Committee [hearing in November] showed there …

Read More »A Less Active CFPB Is Expected After the Bureau’s Temporary Shutdown

A subdued Consumer Financial Protection Bureau is likely to emerge in the wake of the order issued over the weekend to close its offices for the week and have employees work remotely during that period. Acting CFPB director Russell Vought, director of the United States Office of Management and Budget, …

Read More »Judge Grants More Banks Relief from Illinois Interchange Law, But Stops Short of Going All the Way

U.S. District Court Judge Virginia Kendell extended the injunction against Illinois’s pending interchange law late Thursday to include more financial institutions but stopped short of providing blanket relief from the law for all financial institutions and the card networks. Kendall, a judge in the Northern District of Illinois, ruled that …

Read More »COMMENTARY: It’s Not Payments, It’s Politics

In reconnecting with the payments industry after my Congressional run, one topic has come up in conversation more than any other: interchange regulations. Specifically, S.1838, the Credit Card Competition Act of 2023 (CCCA), which takes a market-driven approach to driving down interchange fees. By enabling two credit card networks on …

Read More »Opponents of the Illinois Interchange Law Hedge Their Bets With Legislation To Repeal It

A bill was introduced late Tuesday in the Illinois House of Representatives seeking to repeal the Interchange Fee Prohibition Act. The legislation, introduced by Rep. Margaret Croke, chairperson of the House Financial Institutions and Licensing Committee, is the latest twist in an ongoing battle over the IFPA, which became law …

Read More »Codego Launches Gateway Software While KuCoin Looks to Recover From Its Legal Woes

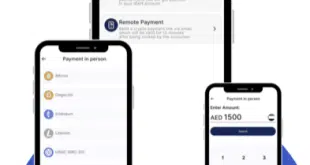

The fintech Codego Ltd. has launched its Cryptogateway software, which enables merchants in 33 countries to accept cross-border in-person and e-commerce transactions in cryptocurrency and receive the funds in fiat money in an IBAN account. IBAN accounts are typically used to hold funds arising from cross-border transactions. The new service, which works …

Read More »