Fifth Third Bancorp said it has closed on its acquisition of Big Data LLC, a technology platform for health-care payments. Terms were not disclosed Mark Barnett, president of Mastercard Inc. for Europe, said card interchange “represents incredibly good value” with respect to “sharing the costs and benefits of the payment system.” The remarks …

Read More »Merchants’ Cost Burden for Card Acceptance Has Long Been Flat, a Card Industry Group Argues

Merchants’ price for accepting credit cards has remained steady for years, according to data released Monday by the Electronic Payments Coalition, an advocacy group representing the payment card industry. The EPC’s release comes as widespread and longstanding merchant complaints about the cost of card acceptance have sparked efforts by federal …

Read More »Amazon Offers Richer Rewards For its Cobranded Visa Cards

Amazon.com Inc. has beefed up the rewards for its Visa-branded cards issued by Chase, in response to cardholder’s desire for travel-related perks and the ability to earn more rewards for day-to-day expenses, such as commuting. Additionally, Amazon is allowing cardholders to redeem rewards daily and has rebranded its cards. Prime …

Read More »As FedNow Gears up for Its July Launch, Specific Applications Beckon, Including Payroll

The official launch of FedNow as a commercial service is set for July, but already the nation’s banking regulator, along with observers, have seen a pattern in where initial participants have been using the real-time payments service. “We’re starting to see more activity around business-to-consumer [payments], related to payroll front …

Read More »Will Visa’s 3% Surcharge Cap, Set for April 15, Push Merchants to Cash Discounts?

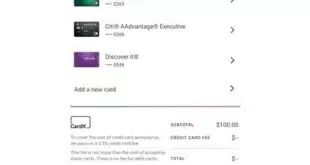

Visa Inc. is poised to lower on Saturday the amount a merchant can surcharge for transactions on its credit cards from a maximum of 4% to 3%, a move it announced early this year. Some observers acknowledge the reduction will happen, though Visa Inc. has not responded to Digital Transactions …

Read More »Square Parent Block Slaps Mastercard And Visa With an Antitrust Suit Over Card Acceptance Costs

In a major case whose effects could ripple widely across the payments industry, Block Inc. has sued Visa Inc. and Mastercard Inc., alleging the global networks worked together to fix interchange fees paid by Block’s Square operation. Square, which processes card transactions for millions of mostly small sellers, pays interchange …

Read More »CardX Expands Online Payment Capabilities with Mastercard Click to Pay

Payment processing platform CardX is making Mastercard Click to Pay available on Lightbox, its online payment form, to all existing and new card-not-present merchants on its platform. Mastercard Click to Pay stores a consumer’s payment information using an encrypted, virtual card number to enable secure online shopping. Lightbox enables consumers …

Read More »As FedNow’s July Debut Nears, the Roadshow Begins

FedNow, the impending real-time payment service from the Federal Reserve, was formally introduced to the merchant-acquiring industry Thursday at the annual Northeast Acquirers Association conference. Expected to launch in July, FedNow will enable participating banks to offer instant payments with a default limit of $100,000 per transaction and stretch to …

Read More »Early Warning Unveils Paze, Its Multi-Bank Wallet Aimed at Easing E-Commerce

Early Warning Services LLC, a fintech owned by seven of the nation’s largest banks, will launch its digital wallet with a pilot this summer followed by general availability in the fall, the top official in charge of the project said Monday. The new wallet, called Paze and aimed exclusively at …

Read More »Will Visa Follow Through on Lowering Its Credit Card Surcharge Cap in April?

Visa Inc. may be readying a lower cap on credit card surcharges—moving from 4% to 3%—in April, but there’s no guarantee it will happen then. While a bulletin sent to large acquirers says the change to the brand rules will go into effect April 15, its implementation could be delayed, …

Read More »