Bitpay, a provider of cryptocurrency-based payments services, said it is working with crypto-technology provider Banxa to enlarge access to payments using digital currency. Shield Compliance, a compliance provider for cannabis banking, issued an open letter to American Express, Discover, Mastercard, and Visa calling on the networks to permit financial institutions …

October, 2023

-

19 October

Expect Real-Time Payments Bloom And Other Digital Transactions News briefs from 10/19/23

Ninety-nine percent of large enterprises—those with annual revenue of $1 billion to $9.9 billion—expect to send real-time payments in the next five years, found the 2023 AFP Real-Time Payments Survey released by the Association for Financial Professionals and sponsored by The Clearing House Payments Co. LLC. It also found that 77% of …

-

18 October

Health iPASS’s New Service And Other Digital Transactions News briefs from 10/18/23

Health iPASS launched Health iPASS Cloud Payments, a processing service for health-care providers. Fiserv Inc. said it is leveraging its merchant-acceptance and card-issuing technology to ease embedded finance for client financial institutions. Metropolitan Commercial Bank said it will deploy cloud-based technology from Finzly to support payment processing via FedNow, Fedwire, and the automated …

-

16 October

AppTech To Acquire Alliance Partners And Other Digital Transactions News briefs from 10/16/23

AppTech Payments Corp., a specialist in business-to-business and business-to-consumer payments, has agreed to acquire Alliance Partners LLC and its FinZeo money-movement software. With the deal, expected to close Oct. 31, AppTech will become a payment facilitator, a company that allows merchants to accept payments on the company’s merchant account. Terms …

-

12 October

Fiserv Secures Data Plan with Plaid And Other Digital Transactions News briefs from 10/12/23

An agreement between processor Fiserv Inc. and open-banking platform Plaid will allow consumers who use any of Fiserv’s 3,000 client banks to share financial information with third-party apps and services. Discover Financial Services’ Discover Global Network launched a cloud-based version of its stored payment tokens service. Tokens are digital replacements for actual card credentials. …

-

10 October

Orum Launches an Instant Account Verification Solution for FedNow

Orum, a provider of technology for payment processing and account verification, announced Tuesday the launch of Verify, an account-verification solution for FedNow, the Federal Reserve’s instant-payment service, which launched in July. With Verify, businesses initiating a payment through FedNow can validate, within 15 seconds prior to sending funds, whether a …

-

9 October

Slake’s Delivery App Supports Crypto Payments; Visa’s Billions in Crypto Volume Since 2021

Slake IT LLC on Monday launched a food-delivery app that enables consumers to pay for orders using cryptocurrency in addition to credit cards. The company, which is supporting the Ethereum platform to enable crypto payments, has partnered with drivers of multiple food-delivery companies, including DoorDash, Uber Eats, and Grubhub, to …

-

3 October

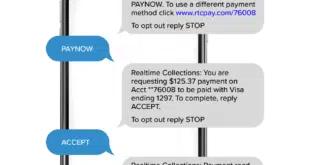

Nuvei Works With Solutions By Text for Embedded Bill Pay And Gains a Footprint in China

Solutions by Text is adding embedded bill-payment capabilities to its FinText messaging and payments platform. Consumers will now be able to pay bills through the FinText platform without leaving the platform’s Web site or mobile app, which creates a more convenient payment experience, the company says. Transactions will be processed …

-

3 October

FedNow Tally at 108, up from 35 And Other Digital Transactions News briefs from 10/3/23

The Federal Reserve said FedNow, its real-time payments service that launched in July with 35 banks and credit unions, now counts 108 participating institutions with 21 others providing liquidity and settlement services and 20 service providers. Kenneth C. Montgomery, the Federal Reserve Bank of Boston first vice president and chief operating officer who spearheaded …

-

2 October

Exchange Bank Picks Pidgin for Real-Time Payments And Other Digital Transactions News briefs from 10/2/23

Payments-technology platform Pidgin said it has agreed to provide real-time payments capability to retail and commercial account holders at Exchange Bank. AffiniPay LLC, a payments platform for professional-services firms, has sold its accounting-software unit, Soluno, to ActionStep, a provider of practice-management technology. Terms were not disclosed. The U.S.-based blockchain firm Coinbase Inc. announced it …