Spotify, the digital-music service, has notified long-time customers it will no longer support payments from Apple Inc.’s App Store for premium subscriptions. Those customers who use the Apple service will be moved to Spotify’s free service and must transition to an alternative, such as PayPal or a credit card, for …

Read More »PayRange Finds its Spot in the Campground and RV Market And Other Digital Transactions News briefs from 7/7/23

PayRange Inc., a provider of mobile payments for unattended markets, has extended its reach into the campground and RV parks market. Payments-technology provider NovoPayment released Orchestra 2.0, a payments-orchestration layer aimed at financial institutions. Paybotic Financial, a payments platform specializing in the cannabis industry, said it has joined the Emerging Market Coalition, a nonprofit …

Read More »Merchant Lynx Acquires National Credit Card Processing; 365 Retail Markets, First American Launch Terminals

Merchant Lynx Services has acquired National Credit Card Processing Group, a provider of B2B payment solutions, for an undisclosed sum. National Card Processing specializes in payment acceptance for the construction and heavy-duty trucking parts and repairs, concrete ready mix, asphalt and aggregate supply, and highway civil construction industries. The acquisition …

Read More »FIS Makes It Official: It’s Selling a 55% Worldpay Stake to GTCR at an $18.5 Billion Valuation

In a fleeting 10-minute conference call, FIS Inc. announced early Thursday a move to sell a 55% interest in its merchant-processing business, which principally consists of the Worldpay unit it acquired four years ago, to the private-equity firm GTCR. The deal is expected to close by the end of the …

Read More »Sabre Acquires Gift Card Platform And Other Digital Transactions News briefs from 7/6/23

Travel-technology provider Sabre Corp. announced it has acquired Techsembly, a gift card and e-commerce platform for hotels. The U.S. Payments Forum published a white paper outlining the impact of the Federal Reserve’s clarification that debit card issuers must enable a choice of two unaffiliated networks for all transactions, including card-not-present payments. The clarification took effect …

Read More »Digital Gift Cards Are Poised to Become a $1 Trillion Market by 2032

The global digital gift card market is projected to reach $1.2 trillion in 2032, up from $310.1 billion in 2022, according to a report from market research firm Custom Market Insights. In 2023, CMI projects sales of digital gift cards will total $399 billion, a more than 28% year over …

Read More »FIS Is Reportedly Working to Sell a Majority Stake in Its Merchant Unit to GTCR

FIS Inc. is talking to the private-equity firm GTCR LLC about taking a majority stake in the Jacksonville, Fla.-based company’s merchant-processing business, according to a report late Monday from Reuters. The report indicates the talks are “advanced” and value the stake at between $15 billion and $20 billion. The latest …

Read More »Apple Renews App Store Payments Appeal And Other Digital Transactions News briefs from 7/5/23

Apple Inc. said it will file a renewed appeal with the U.S. Supreme Court regarding a 2021 case that invalidated Apple’s requirement that App Store businesses accept payments only through Apple’s platform. Keys App Inc., a platform provider for locksmiths, launched its Keys App to enable digital payments for services and …

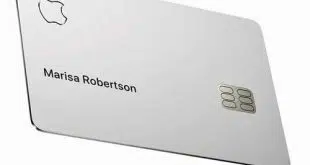

Read More »Why Goldman Sachs Is Looking for the Exit

An overwhelming risk-management burden, coupled with a lack of familiarity with consumer credit, may have triggered the decision at Goldman Sachs Group to negotiate a withdrawal from its agreement to support Apple Inc.’s credit card and its recently launched buy now, pay later service, according to observers. The Wall Street …

Read More »Commentary: Developers Don’t Know Enough About Payments. It’s up to Gateways to Fix That

The fundamental problem with payments software is that, for most developers, it’s a necessary evil. They must integrate payment-transaction capabilities so they can get paid for all the other code they’re writing. Now, thanks to one-size-fits-all application programming interfaces and tokenization that devalues everything, developers barely know a PAN from …

Read More »