Nayax Ltd., a payments processor for vending machines, announced it has launched an EMV-compliant platform allowing multiple choices with a single transaction authorization.Hospitality-technology provider Bite Ninja said it has acquired Zenu, a provider of ordering and payment technology for restaurants. Terms were not announced.BlueOne Card Inc. said it is launching its BlueOne Card, …

Read More »PayPal Logs A Strong Quarter As It Shifts Its Strategy to Boost User Engagement

As all payments companies know, some active accounts are more active than others. On Tuesday, PayPal Holdings Inc.’s top executives made it plain the company’s 2022 priority is to emphasize—and pour money into promoting—accountholder activity. “The shift is, we’re not going to throw marketing dollars at low-value customers coming in,” …

Read More »Trust Payments Acquires Retail Tech Firm and other Digital Transactions News briefs from 2/1/22

Trust Payments Ltd., a payments provider in the U.K., European Union, and U.S. markets, announced it has acquired retail-technology company WonderLane Solutions Ltd. Terms were not announced.In related news, Trust Payments is the first client to go live on a payments platform created by cryptocurrency specialist Ripple Labs Inc. and Moduir Finance …

Read More »Eye On Restaurant POS: Full-Service Eateries Rebound As They Adopt New Payments Tech

Full-service restaurants, one of the hardest-hit merchant segments at the outset of the Covid-19 pandemic, showed signs of a rebound in 2021, according to research by TouchBistro Inc., a provider of POS and restaurant-management applications. Findings from TouchBistro’s third annual “State of Full-Service Restaurants Report” reveals that 74% of full-service restaurants …

Read More »Digital ID Firms Will Cash in As Consumers Pour into Online Commerce, Juniper Projects

Consumers worldwide went online in unprecedented numbers following the onset of the pandemic, but along with that trend comes an increasing need to establish the identities of users, according to a report issued Monday by Juniper Research. As a result, revenue for companies around the world that develop technology that …

Read More »QR Code Transactions Are on the Rise, But Now So Are Concerns About QR Code Fraud

With the Covid-19 pandemic helping fuel broad adoption of Quick Response codes by merchants for payments and ordering, it was only a matter of time before criminals exploited the contactless technology. Fraudsters are creating fake QR codes that, when scanned, take consumers to a bogus landing page that collects payment …

Read More »The Fed Releases Some FedNow Fees and other Digital Transactions News briefs from 1/28/22

The Federal Reserve’s FedNow real-time payments platform will charge a monthly $25 participation fee for each receiving routing transit number, 4.5 cents per credit transfer to be paid by sender, and a penny for a request for payment message, paid by requestor. The Fed expects to release a full fee schedule later this …

Read More »A Re-Energized Visa Sees Growth Coming From ‘BNPL, Crypto, And Wallets’

Visa Inc.’s top executives made it plain Thursday afternoon that the story of the company’s growth into the near future is threefold, including cryptocurrency, cross-border transactions, and the buy now, pay later trend. “Visa is enabling scale for BNPL, crypto, and wallets,” Visa chief executive Alfred Kelly told equity analysts …

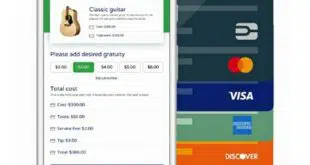

Read More »MagicCube Launches Its Cloud-based Acceptance Platform For Mobile Devices

The vision of turning mobile devices into tap-and-go POS terminals took a big step forward Thursday as MagicCube Inc. announced i-Accept Cloud, an open, cloud-based softPOS acceptance platform. i-Accept Cloud is expected to simplify the creation of new merchant payment acceptance and digital commerce solutions. By connecting the currently siloed …

Read More »Mastercard: All in on Open Banking, But Not on Amazon’s Fee Dispute With Visa

Top executives at Mastercard Inc. made it plain early Thursday the card network is determined to develop its account-to-account payment capabilities, while maintaining its distance from the dispute between its rival Visa Inc. and the e-commerce juggernaut Amazon.com Inc. over transaction pricing. “That’s fundamentally a question for Visa and Amazon,” …

Read More »