The ever-shifting attacks from online criminals has prompted Sift to launch ThreatClusters, a tool to detect similar fraud patterns across industries to better identify risk patterns. San Francisco-based Sift says traditional fraud-detection models too narrowly focus on a single organization’s data or apply insights too broadly across diverse industries. It …

Read More »Affinity Plus Adds FedNow and RTP and other Digital Transactions News briefs from 8/23/24

Affinity Plus, a credit union, announced it has added a real-time payment service based on FedNow and The Clearing House Payments Co.’s RTP network. Ark Labs said it has closed on a $2.5-million funding round led by Tim Draper, a venture capitalist. The startup says the funding will help it as …

Read More »InvoiceASAP Partners With Adyen on Instant Payouts As Real Time Processing Unfolds

InvoiceASAP Inc., a provider of invoicing and payment technology for small and medium-size businesses, has partnered with Adyen NV to provide merchants instant access to deposited funds. InvoiceASAP will leverage Adyen for Platforms, an end-to-end payments and customer-experience platform, to offer its 23,000 merchants immediate access to pending funds and …

Read More »Ransomware Demands Averaged $1.6 Million in Second Quarter, a New Report Says

Ransomware is a sobering item on every organization’s list of things to worry about. New data shows it might be more problematic than ever as the average ransomware demand reached $1,571,667 in the second quarter, more than double the average in the first quarter, according to “Q2 2024 Cyber Threat …

Read More »U.S. Bank Acquires Salucro and other Digital Transactions News briefs from 8/22/24

U.S. Bank has acquired Salucro Healthcare Solutions LLC, a 20-year-old provider of payments and billing technology for the health-care industry. Terms were not announced. The bank first invested in Salucro in 2022 and has sold its services through Elavon, the bank’s payments entity, as a product called MedEpay. Relay Payments, a …

Read More »SocketMobile Rolls Out a Reader for a Growing Market in Payments Triggered by QR Codes

SocketMobile Inc., a provider of mobile data-capture solutions, has launched a countertop QR-code payment reader to enable consumer-presented QR-code operations. The device, called the SocketScan S320, was developed in response to consumer demand for QR-code technology at the point-of-sale, the company says. The global payment market for QR codes totaled …

Read More »As EV Charging Stations Spread, BlueSnap Links With EV Connect for Payments Processing

The number of public charging stations for electric vehicles has nearly doubled over the past five years to more than 61,000, and that’s leading some major payments platforms to view these venues as an increasingly important market. In the latest development, EV Connect, a business-service provider for these stations, has …

Read More »Jack Henry Revenue up 4.7% and other Digital Transactions News briefs from 8/21/24

Processor Jack Henry & Associates Inc. reported June-quarter revenue of $559.9 million, up 4.7% from the same quarter last year. Revenue for the 12-month period came to $2.22 billion, up 6.6%. Net income for the quarter totaled $101 million, a 3.4% increase; for the year ended June 30, $381.8 million, up 4.1%. …

Read More »Payment Orchestration Platforms Now Must Figure Ways to Set Themselves Apart, a Report Warns

As competition among payment orchestrators heats up, providers looking to separate themselves from the pack find themselves under pressure to offer points of differentiation, according to Datos Insights’ “Payment Orchestration Vendor Evaluation” report, released Tuesday. One key differentiator for payment orchestrators is smart payment routing, according to the report. This …

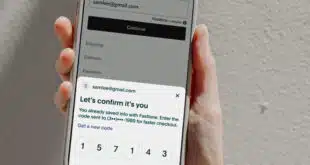

Read More »PayPal Lines up Adyen as a Fastlane Checkout Provider

Having just launched earlier this month, PayPal Holdings Inc.’s Fastlane checkout has lined up processor and competitor Adyen NV as a partner. Designed to accelerate guest checkout flows, Fastlane is meant to help e-commerce retailers boost their conversion rates. Reducing friction in the guest-checkout process can help boost conversion rates for e-commerce …

Read More »